Last Updated: December 20, 2025

This comprehensive guide reveals how to access Xero’s exclusive 90% discount for UK subscribers. Save up to £351 over six months while getting full access to professional cloud accounting software trusted by over 4.6 million businesses worldwide and recognized by HMRC for Making Tax Digital compliance.

🎯 Current Best Offer: 90% Off for 6 Months

⏰ Offer Expires: January 30, 2026 at 11:59 PM GMT

Xero UK is currently offering new customers 90% off their subscription for the first six months, with the discount automatically applied at checkout using promo code DC129046AU.

90% off for 6 Months

💰 Current Xero UK Pricing (December 2025)

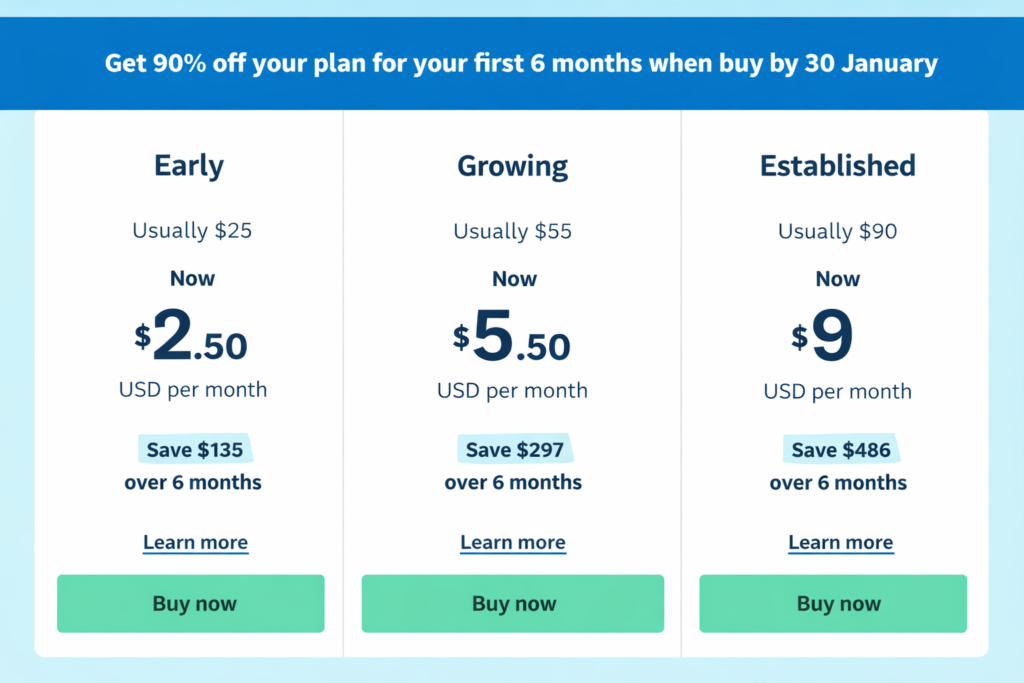

Here’s what you’ll actually pay with the 90% discount:

| Plan | Regular Price | With 90% Discount | 6 Months Total | After Promo (Month 7+) |

|---|---|---|---|---|

| Simple | £7/month | £0.70/month | £4.20 | £7/month |

| Ignite | £16/month | £1.60/month | £9.60 | £16/month |

| Grow | £37/month | £3.70/month | £22.20 | £37/month |

| Comprehensive | £50/month | £5/month | £30 | £50/month |

| Ultimate | £65/month | £6.50/month | £39 | £65/month |

All prices exclude VAT (20%). UK pricing applies.

Your Total Savings:

- Simple Plan: Save £37.80 in 6 months

- Ignite Plan: Save £86.40 in 6 months

- Grow Plan: Save £199.80 in 6 months

- Comprehensive Plan: Save £270 in 6 months

- Ultimate Plan: Save £351 in 6 months

Important: The discount applies to base subscriptions only and does not include add-ons (payroll, projects, expenses), usage charges, or payment processing fees.

90% off for 6 Months

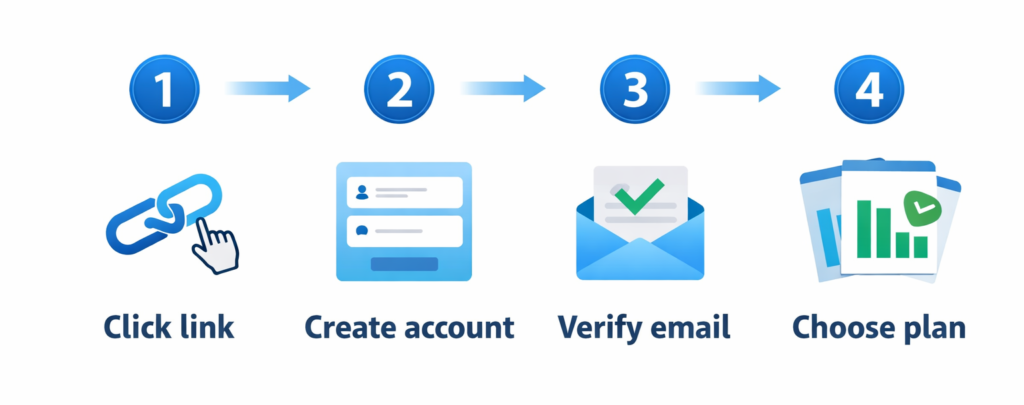

🚀 How to Access the Xero UK 90% Discount (Step-by-Step)

Step 1: Use the Exclusive Discount Link

The promo code DC129046AU is automatically applied when you use official Xero affiliate links. No manual code entry needed—the discount shows at checkout.

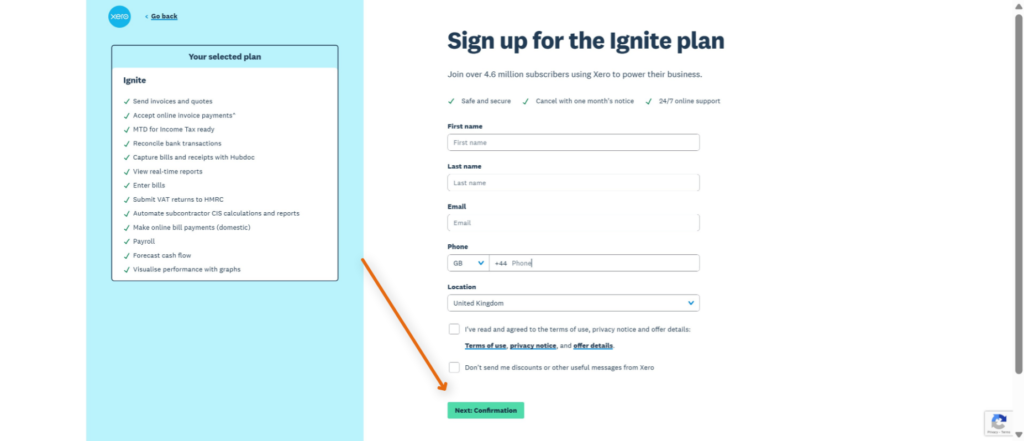

Step 2: Create Your Xero Account

- Review the Ignite plan details on the left. Make sure it fits what you need.

- Enter your first name and last name.

- Add your email address and phone number.

- Confirm your location is set correctly.

- Tick the box to accept the terms, privacy notice, and offer details.

- Click Next: Confirmation to continue.

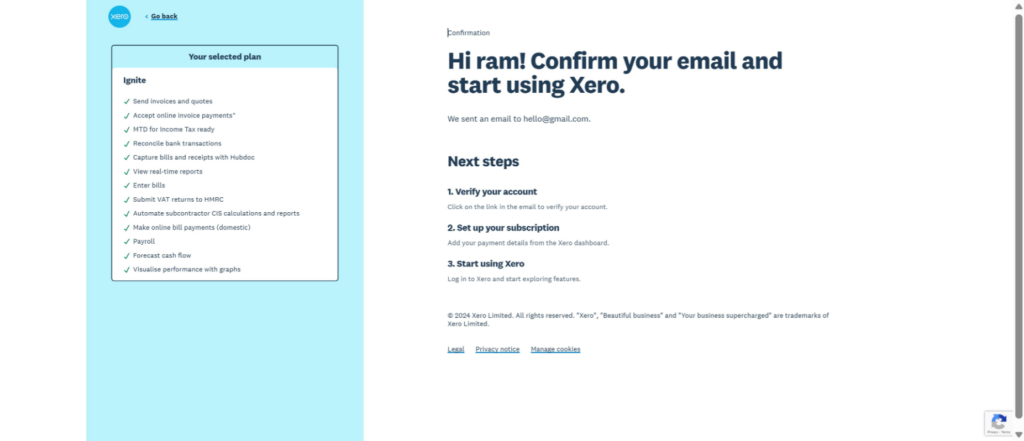

Step 3: Verify Your Email

Check your inbox for Xero’s verification email. Click the confirmation link to activate your account. This usually arrives within 2-3 minutes.

Step 4: Select Your Plan & Complete Payment

Choose the plan that fits your business needs, enter your payment details, and your discounted subscription begins immediately. Xero subscriptions auto-renew monthly until cancelled.

📊 Xero UK Plans Compared: Complete Feature Breakdown

| Feature | Simple | Ignite | Grow | Comprehensive | Ultimate |

|---|---|---|---|---|---|

| Regular Monthly Price | £7 | £16 | £37 | £50 | £65 |

| With 90% Discount (6 months) | £0.70 | £1.60 | £3.70 | £5 | £6.50 |

| Best For | Non-VAT sole traders | VAT-registered small businesses | Growing SMEs | Multi-currency businesses | Large teams with projects |

| Send Invoices & Quotes | 10 per month† | 20 per month† | Unlimited | Unlimited | Unlimited |

| Enter Bills | ❌ | 10 per month | Unlimited | Unlimited | Unlimited |

| Bank Account Connections | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

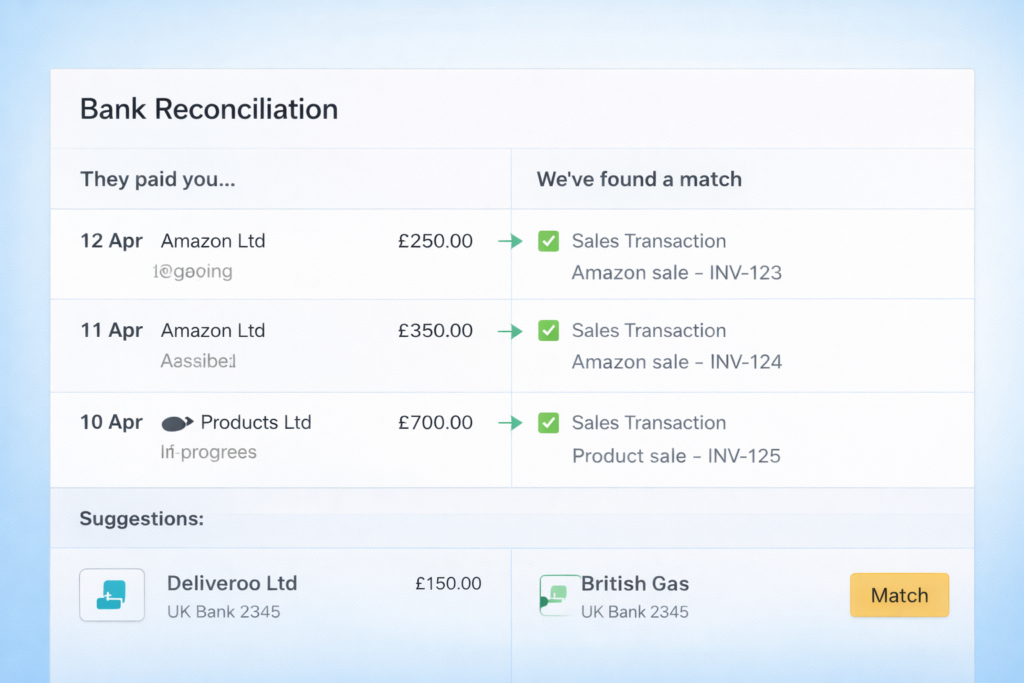

| Reconcile Bank Transactions | Manual | Manual | Auto-reconcile (Beta) | Auto-reconcile (Beta) | Auto-reconcile (Beta) |

| Accept Online Payments | ✅ | ✅ | ✅ | ✅ | ✅ |

| Hubdoc (Receipt Capture) | ✅ | ✅ | ✅ | ✅ | ✅ |

| Real-Time Reports | ✅ | ✅ | ✅ | ✅ | ✅ |

| Submit VAT Returns to HMRC | ❌ | ✅ | ✅ | ✅ | ✅ |

| MTD for Income Tax Ready | ✅ | ✅ | ✅ | ✅ | ✅ |

| CIS Calculations & Reports | ✅ | ✅ | ✅ | ✅ | ✅ |

| Cash Flow Forecasting | ❌ | 30-day | 30-day | 90-day | 180-day |

| Performance Graphs | ❌ | Basic | Advanced | Advanced | Advanced |

| Custom Dashboards | ❌ | ❌ | ✅ | ✅ | ✅ |

| Financial Health Scorecards | ❌ | ❌ | ❌ | ✅ | ✅ |

| KPI & Ratio Analysis | ❌ | ❌ | ❌ | ✅ | ✅ |

| Multi-Currency Support | ❌ | ❌ | ❌ | ✅ | ✅ |

| Payroll | Optional (£1.50/person) | Optional (£1.50/person) | 1 person included (£1.50 extra) | 5 people included (£1.50 extra) | 10 people included (£1/extra) |

| Expense Claims | ❌ | ❌ | 1 user included (£2.50 extra) | 5 users included (£2.50 extra) | 10 users included (£2.50 extra) |

| Bill Payments (Domestic) | ❌ | Optional (£0.20/bill) | 5 included (£0.20 extra) | 10 included (£0.20 extra) | 15 included (£0.20 extra) |

| Bill Payments (International) | ❌ | ❌ | ❌ | Optional | Optional |

| Project Tracking | ❌ | ❌ | ❌ | ❌ | 10 users included (£5 extra) |

| Users Included | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

† Invoice limits for Simple & Ignite plans apply to both approving and sending invoices.

🎯 Best For:

- Simple: Non-VAT registered sole traders, landlords with under 10 invoices/month

- Ignite: VAT-registered freelancers, sole proprietors with basic needs (up to 20 invoices/month)

- Grow: Small businesses with regular invoicing, need auto-reconciliation

- Comprehensive: Businesses trading internationally, need multi-currency support

- Ultimate: Larger teams needing project tracking, 10+ employees on payroll

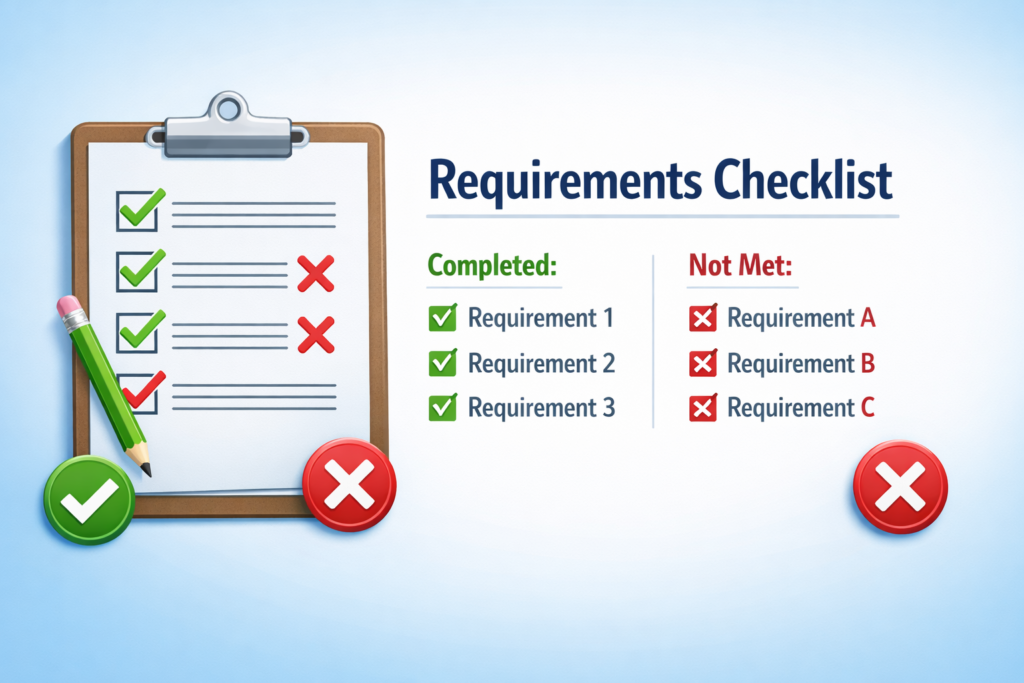

✅ Eligibility & Requirements

Before claiming your 90% discount, ensure you meet these criteria:

Who Qualifies:

✅ New Xero customers only – Must be purchasing your first organization

✅ Valid until January 30, 2026 – Offer expires 11:59 PM GMT

✅ Uses promo code DC129046AU – Applied automatically via affiliate links

✅ UK-based businesses – Available to all UK organizations

✅ Base subscription only – Add-ons, usage charges, and payment fees excluded

✅ All plans eligible – Simple, Ignite, Grow, Comprehensive, Ultimate

Who Does NOT Qualify:

❌ Previous Xero subscribers (even if cancelled)

❌ Attempting to combine with other promotional offers

❌ Existing Xero users adding additional organizations

❌ Business already registered under another Xero account

Note: After the first 6 months, Xero’s then-current regular price will apply and auto-renew monthly until cancelled.

💼 Switching from QuickBooks, Sage, or Other Software?

Quick Migration Steps

Many UK businesses successfully migrate to Xero from competing platforms. Here’s how:

1. Export Your Data

- QuickBooks: Accountant’s Copy or List Export (IIF format)

- Sage: Export customers, suppliers, and chart of accounts to CSV

- FreeAgent: Export contacts and transactions to CSV

2. Prepare Your Xero Account

- Set up your UK chart of accounts (CoA)

- Configure VAT rates (Standard 20%, Reduced 5%, Zero-rated)

- Add bank connections (Open Banking integration)

3. Import Your Data

- Use Xero’s built-in import tools for contacts and opening balances

- Manual entry for chart of accounts (recommended for accuracy)

- Upload historical transactions via CSV files

4. Run Parallel Systems

- Operate both systems for 30-60 days to ensure accuracy

- Compare VAT returns between old and new system

- Verify all bank reconciliations match

5. Get Migration Support

- Free onboarding assistance available

- Access to certified Xero accountants via Xero Advisor Directory

- Comprehensive help center with UK-specific migration guides

🌟 What Makes Xero Worth Your Investment?

[IMAGE PLACEHOLDER: Professional screenshot of Xero’s main dashboard showing cash flow, invoicing, and bank connections in action with UK-specific elements]

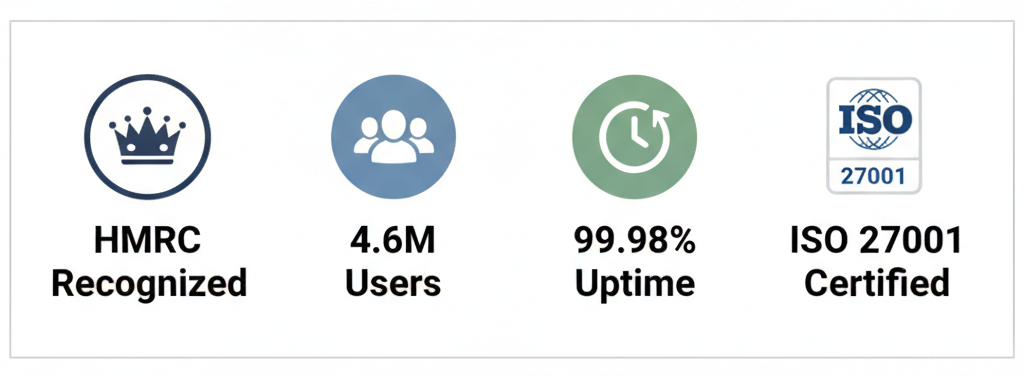

With over 4.6 million users in 180+ countries and strong UK market presence, Xero has become one of the UK’s most popular cloud accounting platforms.

Core Features

Smart Bank Reconciliation

Automated transaction matching with 95%+ accuracy using Open Banking. Connect to 99% of UK banks at no extra cost (some banks may charge feed fees).

Professional Invoicing

- Create branded invoices with your logo and colors

- Accept online payments via Stripe or GoCardless

- Automatic payment reminders for overdue invoices

- Median payment time reduced when invoices sent via SMS with payment services

HMRC Integration & MTD Compliance

- Submit VAT returns directly to HMRC

- Making Tax Digital (MTD) for VAT compliant

- MTD for Income Tax ready (from April 2026)

- Automatic VAT calculations on purchases and sales

- Digital links to prevent manual transcription errors

Mobile Apps (iOS & Android)

Full-featured mobile apps let you:

- Create and send invoices on the go

- Snap photos of receipts for instant digitization

- Check cash flow and financial dashboards

- Approve bills and make payments

- Reconcile bank transactions

Hubdoc Document Management

- Photograph receipts with your phone

- Automatic data extraction and categorization

- Syncs directly to your Xero account

- Included with all plans at no extra cost

- Fetch bills directly from supplier websites

Real-Time Financial Reporting

- Profit & Loss statements updated continuously

- Cash flow tracking and forecasting (30-180 days depending on plan)

- Balance sheets and financial ratios

- Customizable performance dashboards (Grow+ plans)

- Budget vs actuals tracking

UK Payroll Processing

- Native Xero Payroll for UK businesses

- Automatic PAYE and National Insurance calculations

- Real-Time Information (RTI) submissions to HMRC

- Pension auto-enrolment support

- P60s, P45s, and P11D generation

- Statutory payments (SSP, SMP, SPP) calculations

Integration Ecosystem

Xero connects with 1,000+ third-party applications:

UK Payment Processing: Stripe UK, GoCardless, PayPal UK, Worldpay, SumUp

E-commerce: Shopify, WooCommerce, BigCommerce, eBay, Amazon

CRM: Salesforce, HubSpot, Zoho CRM, Pipedrive

Time Tracking: Harvest, Toggl, TimeCamp

Inventory: TradeGecko, Unleashed, Cin7, DEAR Inventory

Shipping: Royal Mail Click & Drop, DPD, Evri, Parcelforce

Receipt Scanning: Dext (formerly Receipt Bank), AutoEntry

Accounting Add-ons: Practice Ignition, Karbon, Futrli

⚖️ Honest Comparison: Xero vs UK Competitors

| Feature | Xero | QuickBooks Online | Sage | FreeAgent | Zoho Books |

|---|---|---|---|---|---|

| Starting Price (UK) | £7/mo | £15/mo | £14/mo | £15/mo | £10/mo |

| With Promotions | £0.70/mo (90% off) | Varies | 50% off first 3 months | 30-day trial | 14-day trial |

| User Interface | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Mobile Experience | Excellent | Very Good | Good | Excellent | Good |

| Integrations | 1,000+ | 750+ | 300+ | 100+ | 500+ |

| Multi-Currency | ✅ (Comprehensive+) | ✅ | ✅ (Premium+) | ✅ | ✅ |

| Project Tracking | ✅ (Ultimate) | ✅ | ✅ (Premium+) | ✅ All plans | ✅ |

| UK Payroll Included | ✅ (paid add-on) | ❌ (separate subscription) | ✅ (some plans) | ✅ All plans | ❌ |

| MTD VAT Compliant | ✅ | ✅ | ✅ | ✅ | ✅ |

| Customer Support | Email, Chat | Phone, Email, Chat | Phone, Email | Email, Chat | |

| Unlimited Users | ✅ All plans | ❌ User limits | ❌ User limits | ✅ All plans | ❌ User limits |

| Bank Connections | Unlimited (99% UK banks) | Unlimited | Limited | Unlimited | Unlimited |

| Best For | Growing UK SMEs | Established businesses | Traditional accountants | Freelancers | Price-conscious businesses |

When to Choose Xero:

✅ You need unlimited users without extra fees

✅ Strong UK-specific features (VAT, MTD, HMRC integration)

✅ You value modern, intuitive interface design

✅ You want extensive third-party integrations

✅ You plan to scale internationally (multi-currency)

✅ You prefer mobile-first cloud accounting

✅ Working with a Xero-certified accountant

When Competitors Might Be Better:

❌ QuickBooks: Better if you need included phone support on all plans

❌ Sage: Better for very traditional accountants familiar with legacy Sage systems

❌ FreeAgent: Better if you’re self-employed and want payroll included in all plans

❌ Zoho Books: Better if budget is extremely tight (but fewer features)

👥 Real UK Business Owner Experiences

[IMAGE PLACEHOLDER: Testimonial cards with business logos, owner photos, and 5-star ratings]

“Switching from Sage to Xero was the best decision for our construction business. The CIS calculations are automatic, and submitting to HMRC is one click. The 90% discount made the transition risk-free.”

— James Parker, Construction Director | Birmingham, UK

“As a VAT-registered sole trader, the Ignite plan is perfect. I can submit my VAT returns to HMRC directly, and Hubdoc means I never lose a receipt. Paying £1.60/month for six months was incredible value.”

— Sophie Chen, Freelance Designer | London, UK

“We export to 15 countries, so multi-currency support is essential. The Comprehensive plan handles everything—auto currency conversion, multi-currency invoicing, and detailed FX reports. Worth every penny.”

— David Thompson, E-commerce Director | Edinburgh, Scotland

Trust Indicators:

- 4.6 million+ active users worldwide

- Strong UK market presence with HMRC recognition

- 99.98% platform uptime

- ISO 27001 certified

- HMRC recognized for Making Tax Digital

🎓 UK-Specific Training & Support

Available to All Plans:

📚 Xero Central UK – Knowledge base with UK-specific guides

💬 24/7 Live Chat – UK support team during business hours

📧 Email Support – Response within 24 hours

🎥 Xero U – Free video courses on UK accounting

🏪 Xero Community UK – Forums with UK business owners

📱 Twitter Support – @XeroSupport

UK-Specific Resources:

🇬🇧 MTD VAT Guides – Step-by-step HMRC submission help

💷 UK Payroll Documentation – PAYE, NI, pension setup

📊 CIS Contractor Guides – Construction Industry Scheme

🏦 UK Banking Integration – Open Banking connection help

📈 UK Tax Year End – Closing books guidance (April 5)

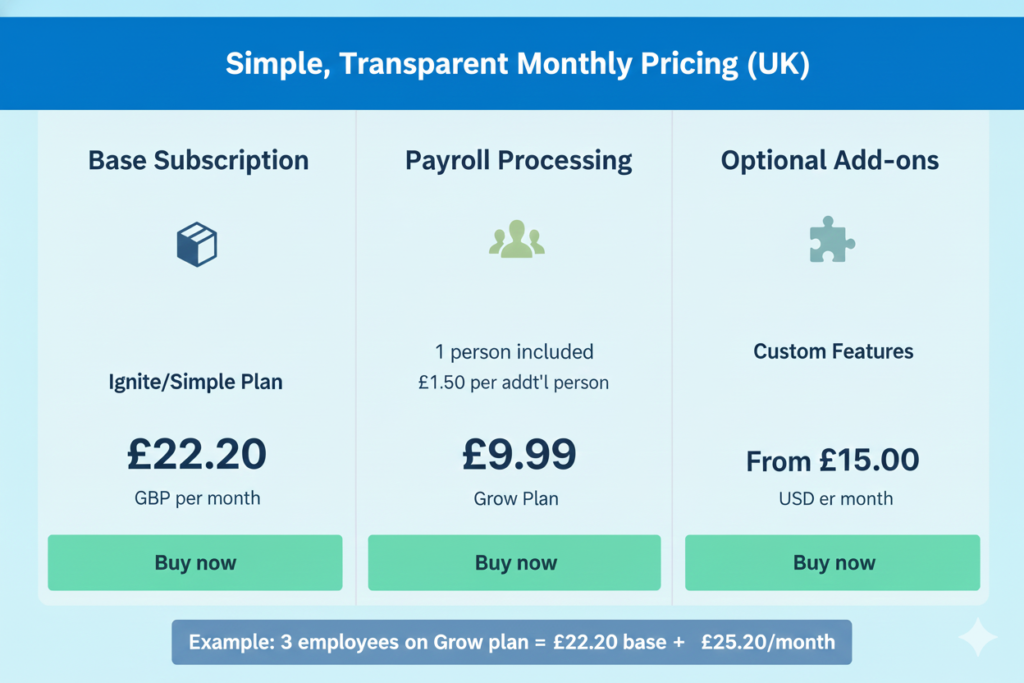

💰 Additional Costs to Consider (UK-Specific)

Payroll Charges

All Xero UK plans can add payroll:

- Ignite/Simple: £1.50 per person per month

- Grow: 1 person included, £1.50 per additional person

- Comprehensive: 5 people included, £1.50 per additional person

- Ultimate: 10 people included, £1 per additional person

Example: 3 employees on Grow plan = £22.20 base + £3 payroll = £25.20/month

Online Payment Processing

Stripe (Credit/Debit Cards):

- UK domestic cards: 1.5% + 20p

- Premium UK cards: 1.9% + 20p

- European cards: 2.4% + 20p

- International cards: 2.9% + 20p

GoCardless (Direct Debit):

- 1% per transaction

- Maximum £5.60 per transaction

- +0.3% for transactions over £2,000

Bill Payments

Domestic UK Payments: £0.20 per bill (some included depending on plan)

International Payments: Payment fees apply (Comprehensive & Ultimate only)

Optional Add-ons

- CIS Returns: £5/month (Construction Industry Scheme)

- Expenses: £2.50 per additional user beyond plan limit

- Projects: £5 per additional user beyond plan limit (Ultimate only)

- Bank Feed Fees: Some UK banks charge (Barclays, HSBC typically free)

VAT

All Xero subscription prices exclude VAT. Add 20% VAT to all costs:

- Simple: £7 + VAT = £8.40/month

- Ignite: £16 + VAT = £19.20/month

- Grow: £37 + VAT = £44.40/month

- Comprehensive: £50 + VAT = £60/month

- Ultimate: £65 + VAT = £78/month

⚠️ Important Limitations to Consider

While Xero is excellent for most UK SMEs, it’s important to understand its limitations:

Potential Drawbacks:

Learning Curve

- Expect 2-4 weeks to become proficient

- More complex than basic spreadsheets

- Worth it for automation, but not instant

- Best to work with Xero-certified accountant initially

Payroll Costs Add Up

- Not included in base subscription (except limited numbers)

- £1-£1.50 per employee per month

- For 10 employees: adds £10-£15/month

- FreeAgent includes payroll for all employees

Add-on Dependency

- Many features require paid add-ons

- CIS: +£5/month

- Expenses: +£2.50/user beyond included

- Projects: Only available on Ultimate (£65/month)

Bank Feed Charges

- Some UK banks charge for Open Banking feeds

- Barclays, HSBC, Lloyds: Usually free

- Check Xero’s bank feed charges page before signing up

No Phone Support

- Email and chat only

- No direct phone line for support

- Response times can be 12-24 hours

- Differs from QuickBooks which offers phone support

VAT on Top

- All prices exclude 20% VAT

- Actual costs are 20% higher than advertised

- Example: £37 plan = £44.40 inc. VAT

Price Increases

- September 2025 saw price increases

- Grow: £33 → £37 (12% increase)

- Comprehensive: £47 → £50 (6% increase)

- Ultimate: £59 → £65 (10% increase)

Who Should Look Elsewhere:

❌ Complete beginners wanting free software → Wave or Zoho Books free plan

❌ Businesses needing phone support → QuickBooks Online

❌ Self-employed wanting all-in-one with payroll → FreeAgent

❌ Very traditional accountants → Sage

❌ Complex manufacturing/job costing → Sage 50cloud or SAP

🇬🇧 UK-Specific Features & Compliance

[IMAGE PLACEHOLDER: UK flag with Xero logo and list of UK-specific compliance features]

HMRC Integration

- Making Tax Digital (MTD) for VAT – Submit returns directly to HMRC

- MTD for Income Tax Self Assessment – Ready from April 2026

- Real-Time Information (RTI) – Automatic payroll submissions

- CIS Returns – Construction Industry Scheme submissions

- Digital VAT Records – Compliant digital links maintained

VAT Management

- Standard Rate: 20% (most goods and services)

- Reduced Rate: 5% (fuel, children’s car seats)

- Zero Rate: 0% (books, most food, children’s clothing)

- Exempt: No VAT (insurance, postage stamps, rent)

- Reverse Charge: B2B services from EU suppliers

- EC Sales Lists: For EU B2B sales

- VAT Cash Accounting Scheme: Supported

- Flat Rate VAT Scheme: Supported

UK Tax Year Support

- Tax Year: April 6 – April 5 (not January-December)

- Year-End Tools: Guided closing process

- Opening Balances: Import previous year accurately

- Reports: P&L and Balance Sheet by UK tax year

Industry-Specific

- CIS for Construction: Automatic calculations and HMRC submission

- Landlord Features: Property tracking, rental income

- E-commerce: Integration with UK marketplaces

- Retail: Point of sale integrations for UK retailers

❓ Frequently Asked Questions (UK)

How does the 90% discount work?

The discount of 90% off applies to your first 6 months on Simple, Ignite, Grow, Comprehensive, or Ultimate plans. After 6 months, you’ll be charged the regular monthly rate. The subscription auto-renews monthly until you cancel.

Do I need a promo code?

The promo code DC129046AU is automatically applied when you sign up through official Xero affiliate links. You’ll see the discount confirmed at checkout.

Is VAT included in the pricing?

No. All Xero UK prices are excluding VAT. Add 20% VAT to all subscription costs. Example: £37 Grow plan = £44.40 including VAT.

Can existing customers get this discount?

No. This promotion is exclusively for new Xero customers purchasing their first organization. The offer cannot be used with or exchanged for any other offer.

Can I start with the 30-day free trial first?

Yes! Xero offers a 30-day free trial with full feature access. No credit card required. However, the 90% discount for 6 months (£4.20-£39 total) delivers much better value than one free month.

What happens after the 6-month promotional period?

Your subscription automatically renews at the regular monthly rate (£7-£65 + VAT depending on your plan). You’ll receive email reminders 30 and 7 days before the rate change.

Can I cancel anytime?

Yes. Xero subscriptions auto-renew monthly until cancelled. There are no cancellation fees or long-term contracts. Your discount ends if you cancel before 6 months.

Is Xero compliant with Making Tax Digital?

Yes. Xero is HMRC-recognized software for Making Tax Digital for VAT. It’s also ready for MTD for Income Tax Self Assessment (launching April 2026).

Do I need to be VAT registered?

Not necessarily. The Simple plan is designed for non-VAT registered businesses (sole traders, landlords). All other plans support VAT registration and HMRC submissions.

Does Xero include UK payroll?

Payroll is available as an add-on on all plans. Pricing: £1-£1.50 per employee per month. Some plans include a certain number of employees (Grow: 1, Comprehensive: 5, Ultimate: 10).

Can I connect my UK bank account?

Yes. Xero connects to 99% of UK banks via Open Banking. Most banks don’t charge for this service. Check Xero’s bank feed charges page for your specific bank.

How many users can access my account?

All Xero plans include unlimited users at no extra cost. This is a major advantage over QuickBooks and Sage, which charge per user.

Can I use Xero for multiple UK businesses?

Yes, you can add multiple organizations to your Xero account. Each requires a separate subscription, but Xero offers discounts when subscribing to multiple organizations using the same email address.

What if I need help with setup?

Find a Xero-certified accountant or bookkeeper in the UK through the Xero Advisor Directory. Many offer setup packages starting from £200-£500.

📚 Additional UK Resources

Related Guides:

📖 Complete Xero Review 2025 – In-depth analysis

📊 Best Accounting Software Compared – Xero vs QuickBooks