Sin tonterías. Esta es la lista de verificación que realmente necesitas para elegir un software de contabilidad que no te ralentice, te cueste caro ni te haga fracasar a la hora de pagar impuestos. Te explicaré lo que importa en el año 2026, cómo se comparan las grandes empresas y los pasos para elegir, migrar y asegurarte el software que mejor se adapte a tu negocio.

Lo corto y conciso (léelo y actúa)

Para elegir el software, tendrá en cuenta tres aspectos: su flujo de trabajo, sus necesidades de integración y cuánto está dispuesto a pagar por la comodidad. Si desea una respuesta rápida:

| Tipo de negocio / Necesidad | El software más adecuado | Fuentes) |

|---|---|---|

| Grandes necesidades generales de las pequeñas empresas | QuickBooks en línea | Investopedia, QuickBooks |

| Pequeña empresa en crecimiento con necesidades internacionales y multiusuario | Xero | Xero |

| Presupuesto ajustado o grandes necesidades de CRM/stack | Libros Zoho | Zoho, Tech.co |

Ahora léalo completo. Explica por qué existen esas respuestas, qué hay que tener en cuenta en 2026 y cómo actuar sin arruinar la nómina ni perder recibos.

¿Por qué importa (aún) el software de contabilidad que elijas?

¡Esto no es solo contabilidad! Su sistema contable es la base de aspectos como el flujo de caja, el cumplimiento tributario, la nómina, las decisiones de precios y la credibilidad de los inversores. Si elige mal, dedicará incontables horas a la conciliación y dinero a corregir errores, lo que puede afectar su toma de decisiones basada en datos erróneos. Si elige bien, obtendrá conciliaciones automatizadas, una facturación más rápida, una preparación de impuestos más sencilla y tendrá el espacio para gestionar el negocio.

Qué cambió en 2026 (A tener en cuenta)

Se trata de automatización y consolidación. Los profesionales del marketing están promocionando funciones que eliminan la parte "manual" de la contabilidad: conciliación bancaria más inteligente, categorización automática y pagos/cuentas por cobrar (BNPL, pagos instantáneos) integrados en el producto. Los precios también han aumentado; QuickBooks y otras empresas cambiaron sus planes en 2026; téngalo en cuenta para la elaboración de presupuestos.

QuickBooks

Xero

Se espera que haya más herramientas de pagos y flujo de caja integradas en las plataformas de contabilidad. Estas ofrecen menos integración, pero una mayor dependencia del proveedor. De nuevo, esto seguirá creciendo. Xero continúa implementando más soluciones de pagos y pagos atrasados con sus socios.

El australiano

Los únicos criterios de decisión que importan: utilice esta lista de verificación

No les daré una sopa de funciones. Usen estos siete filtros, en ese orden.

Necesidades básicas de contabilidad

La facturación, los datos bancarios, la conciliación automatizada, el plan de cuentas, el balance de comprobación y el inventario básico (si tiene existencias de bienes) son la base.

Nómina y cumplimiento

¿Se encarga de la nómina? ¿Qué tan compleja es? (Multiestatal, contratistas, depósitos de beneficios). Las funciones o integraciones de nómina serán mucho más importantes que las campanas para la mayoría de las pequeñas empresas.

Integraciones y ajuste de pila

¿Se integrará fácilmente con su punto de venta, comercio electrónico (Shopify, WooCommerce), CRM y software de impuestos? ¿Cuántas conexiones de terceros necesita?

Informes y acceso de contables

¿Puede iniciar sesión su contador? ¿Es fácil extraer estados financieros y balances de comprobación? ¿Se exportan los informes a Excel correctamente?

Multiusuario y permisos

¿Necesita acceso basado en roles, registros de auditoría y límites de usuarios? Precios y coste real

Busque no solo el plan principal, sino también las tarifas de transacción, los complementos de nómina, los puestos de usuario, etc. Espere cambios de precios en 2026 de muchos proveedores y planifique aumentos en su presupuesto.

QuickBooks

Xero

Propiedad y exportabilidad de los datos

¿Puedes obtener una copia completa de tus datos? ¿Existe una copia de seguridad? Si te vas, ¿podrías tener un conjunto de datos utilizable?

Estos filtros son útiles para evaluar a cada proveedor que considere. Si un producto no es adecuado para la contabilidad básica, deséchelo.

Breve descripción general de los proveedores (conceptos básicos para 2026)

Les daré un resumen de los principales contendientes y para qué tipo de negocio son más adecuados. Estas son notas prácticas, no listas de características.

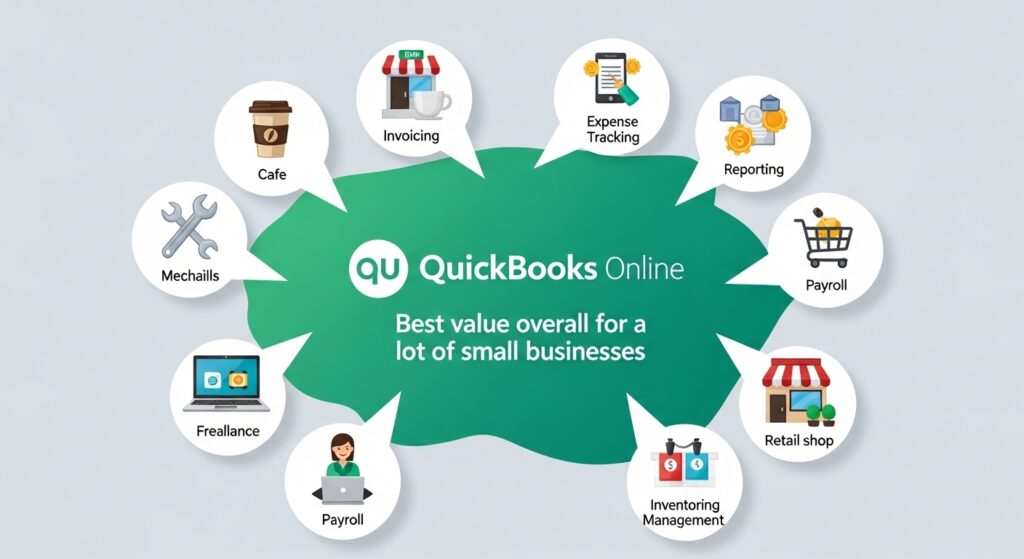

QuickBooks Online: la mejor opción en general para muchas pequeñas empresas

Por qué se seleccionó: Muchas de las funciones de la aplicación, un amplio ecosistema de socios, y los contadores la conocen bien. QuickBooks se centra en la automatización de tareas, nóminas e integraciones. Se esperan cambios continuos en precios y planes en 2026; el presupuesto debe ajustarse a ellos.

Investopedia

QuickBooks

Mejor para:empresas que desean una herramienta de contabilidad completa con nóminas, pagos y ecosistema de aplicaciones extendido (retail con TPV, empresas de servicios, agencias).

Esté atento a:la complejidad de los precios y el coste de los complementos de nómina y los informes avanzados.

Xero: contabilidad limpia para pequeñas empresas con excelente flujo multiusuario

¿Por qué se selecciona? Experiencia de usuario moderna, excelentes herramientas de conciliación bancaria, sencillas funciones de colaboración para contables y un ecosistema que impulsa herramientas de flujo de caja y de pago. Xero implementa continuamente integraciones que reducen el trabajo manual, ayudando a las pequeñas empresas en su etapa de crecimiento.

Xero

Mejor parar: con informes limpios, las pequeñas empresas en crecimiento que necesitan acceso simple para múltiples usuarios y pasos de conciliación sólidos son las mejores opciones.

Esté atento a:límites de usuarios/funciones por plan y aumentos en los precios de los planes en el año 2026.

Zoho Books: la mejor relación calidad-precio con paquete completo, ideal si ya usas el paquete Zoho

Por qué se selecciona: Precios accesibles, planes flexibles y buena integración con el resto del stack de Zoho (CRM, Proyectos, Inventario). Para las empresas que ya utilizan Zoho, estas suelen ser las opciones más económicas para acceder a un ecosistema completo.

Zoho

Tech.co

Mejor para: emprendedores individuales, pequeñas empresas de servicios, negocios que están todos interesados en Zoho.

Esté atento a:Si implementas Zoho y luego lo abandonas, la desventaja es el bloqueo del ecosistema.

FreshBooks: empresas de servicios y autónomos

Por qué se ha seleccionado: Excelente seguimiento del tiempo, facturación sencilla con los clientes y otras funciones que se adaptan perfectamente a los proveedores de servicios. Es extremadamente fácil de usar y permite una contabilidad sencilla con tarifas facturadas a los clientes y facturación.

Mejor para:autónomos, consultores y agencias que facturan por horas y quieren las facturas más pulidas.

Esté atento a: Las funciones de inventario de FreshBooks son menos sólidas y los informes no son tan potentes como los de QuickBooks y Xero.

Wave: gratuito para lo básico, pago para nóminas y pagos

Por qué lo elegimos: Contabilidad y facturación totalmente gratuitas para pequeñas empresas; usted paga los pagos y la nómina. Si busca contabilizar y facturar desde un solo lugar sin usar funciones avanzadas, esto le ahorrará mucho dinero.

Mejor para:microempresas, autónomos y trabajos secundarios.

Mira for: limitaciones en soporte y escalamiento.

Sage, Microsoft Business Central y actores especializados

Son más adecuados para empresas que están adoptando un modelo ERP o que necesitan funciones específicas de su sector. Si bien pueden resultar excesivas para muchas pequeñas empresas, son ideales si su inventario o fabricación son complejos.

Cómo calificar proveedores para su negocio (matriz simple)

Establezca una puntuación de 0 a 5 para cada proveedor en las siguientes categorías:

- Contabilidad básica (0 – 5)

- Nómina (0 – 5)

- Integraciones (0 – 5)

- Acceso a informes y contabilidad (0 – 5)

- Costo (0 a 5, incluida su mejor estimación del costo de 12 meses)

- Portabilidad y seguridad de datos (0 – 5)

Ponderarlos según su importancia. Por ejemplo, si la nómina representa el 40% de su decisión, simplemente multiplique la puntuación del proveedor para la nómina por 0,4. Luego, elija al proveedor cuyas puntuaciones le favorezcan. Recomiendo realizar la puntuación trimestralmente, al menos durante el primer año; no se complique demasiado. Debería poder eliminar a los perdedores rápidamente.

La realidad de los precios en 2026

Nos ha pasado lo mismo. Los proveedores anunciaron actualizaciones de precios en 2026 para QuickBooks y Xero, así como actualizaciones para todos los planes. Esto significa que los precios de referencia anteriores (por ejemplo, "$20/mes") podrían quedar obsoletos. Considere duplicar el precio en los años de renovación y considere los complementos al evaluar el precio: nómina, informes avanzados, licencias para usuarios adicionales y procesamiento de pagos.

QuickBooks

Xero

También considere comparar las ventajas y desventajas de la facturación anual con la mensual. La facturación anual parece más económica, pero le resultará un poco cara. Si está probando con un producto de suscripción, probablemente empezaría con una mensual hasta que esté satisfecho y luego cambiaría a la anual.

Integraciones: no subestimes esto

En su mayoría, las pequeñas empresas trabajan en un ecosistema de aplicaciones: TPV, comercio electrónico, CRM, proveedor de nóminas, control de tiempo, software de impuestos, información bancaria y más. La integración entre ellos es donde se produce el ahorro de tiempo. Dos reglas:

- Cuando el software incluye una integración nativa para una aplicación crítica (Shopify, Stripe, PayPal, su distribuidor de nómina), utilícela en lugar del pegamento Zapier.

- En el caso de aplicaciones menos comunes, verifique si el proveedor tiene una API o si existen socios certificados. Si va a necesitar un desarrollador para conectar las aplicaciones, asigne ese tiempo y dinero desde el principio.

Seguridad y cumplimiento: un punto sin retorno

Sus datos contables contienen información personal identificable (PII) e información financiera. Compruebe:

- Autenticación de dos factores y acceso basado en roles.

- Cifrado de datos en reposo y datos en tránsito.

- Copias de seguridad periódicas y posibilidad de exportar datos fácilmente.

- Características de cumplimiento fiscal local si opera en jurisdicciones reguladas.

Si acepta pagos, verifique el cumplimiento de PCI y quién almacenó los datos de la tarjeta. Para operaciones internacionales, verifique la compatibilidad con múltiples divisas y si el software puede procesar una instantánea del tipo de cambio.

Migración: cómo moverse sin derrumbarse

El proceso de migración es el aspecto más estresante de todo el proceso, simplemente opte por lanzarse directamente a ello.

Audite sus datos actuales

Compile una lista de su plan de cuentas, facturas abiertas, cuentas abiertas, historial de nómina, artículos de inventario y extractos bancarios de los últimos 12 meses.

Limpiar primero

Concilie cada cuenta bancaria con el último mes cerrado. Corrija errores evidentes: migrar información no relevante genera información no relevante. Cierre las cuentas que no sean relevantes.

Exportar todo

Obtenga exportaciones en formato CSV de clientes, proveedores, facturas, productos, plan de cuentas y balance de comprobación. Obtenga una copia en PDF de los informes clave.

Utilice herramientas de migración o su contador

Muchos proveedores le ofrecerán servicios de migración o tienen socios. Si tiene una nómina o un inventario complejos, contrate a un profesional.

Ejecución paralela

No cambie de sistema desde el primer día. Utilice el nuevo sistema simultáneamente durante un mes con el antiguo. Envíe una factura real con el nuevo sistema y otra con el antiguo para poder probar los cobros y las conciliaciones bancarias.

Lista de verificación de transición (semana de transición)

Congelar el corte de AR/AP (no permitir nuevas entradas en los sistemas antiguos), garantizar que se ingresen los saldos de apertura, conciliar el saldo bancario de apertura con las transacciones importadas y garantizar que haya continuidad en la nómina.

Seguimiento de la copia de seguridad y archivo de datos

Después de la transición, mantenga una copia de seguridad de su antiguo sistema al menos durante el período de retención de registros legales; los necesitará para fines de auditoría.

Implementación: tácticas de la vida real que ahorrarán tiempo

No sobreentrenes, solo documenta: no es necesario un entrenamiento exhaustivo. Organiza una sesión grupal de 60 minutos con tu equipo y grábala. Graba ese video y crea una hoja de trucos de una página para el proceso de fin de mes.

Automatizar las reglas bancarias: configure reglas de alimentación bancaria para proveedores comunes para automatizar la categorización.

Utilice facturas recurrentes: configure la facturación automática donde sea posible para reducir el DSO.

Configurar permisos: restringir quién puede anular transacciones. Normalmente, una gran cantidad de cambios manuales implica una discrepancia en los permisos.

Programe una revisión mensual: un cierre mensual le ahorrará entre 30 y 60 minutos en lugar del pánico reactivo que tendría que afrontar al reparar los trenes. Tenga una lista de verificación sencilla: conciliar el banco, procesar la caja chica, verificar las cuentas por cobrar vencidas y revisar la cuenta de pérdidas y ganancias.

Contadores: no los traten como soporte técnico

Involucre a su contador durante el proceso de selección. Puede:

- Asegúrese de que su plan de cuentas sea válido antes de migrarlo.

- Asegúrese de que sus informes fiscales y exportaciones funcionen.

- Ayude con la migración o recomiende un contable.

Si su contador cobra por hora, involucrarlo lo antes posible le permitirá ahorrar dinero.

Consideraciones especiales para algunos tipos comunes de negocios

Comercio minorista/comercio electrónico

Busque un sistema que ofrezca un buen inventario, un buen costo de los bienes vendidos (COGS) a nivel de SKU, integraciones con Shopify y conectores TPV. Hablaremos más sobre QuickBooks y Xero más adelante, ya que cuentan con ecosistemas consolidados para el comercio minorista.

Empresas de servicios

El seguimiento del tiempo y la rentabilidad del proyecto son fundamentales. FreshBooks y QuickBooks Time (anteriormente TSheets) son dos opciones populares para trabajos de servicio.

Trabajadores autónomos

Si solo almacena facturas y realiza un seguimiento de gastos, incluso Wave o Zoho Books pueden ser suficientes y más económicos.

Inventario de fabricación/complejo

Si utiliza órdenes de trabajo, listas de materiales o seguimiento del taller, es posible que le convenga considerar un ERP con un módulo de contabilidad como Sage o Business Central.

Internacional/Múltiples monedas

Seleccione un sistema que ofrezca una buena funcionalidad multidivisa y un buen enfoque educativo para usar la instantánea de divisas adecuada. Xero y QuickBooks gestionan informes multidivisa, pero asegúrese de verificar qué nivel/plan incluye el cambio de divisas y las comisiones asociadas.

Banderas rojas que significan pare, no firme

El proveedor no puede proporcionar una copia de seguridad completa, exportable y legible por máquina de sus datos.

No existe una manera sencilla para que su contador acceda y cree informes legales.

Las integraciones estarán disponibles “próximamente” sin fecha determinada.

Los precios son vagos e incluyen tarifas adicionales por nómina, cantidad de usuarios o cantidad de informes.

No existen procedimientos de seguridad documentados o 2FA es una opción.

Si recibes dos o más de esas señales, camina. Ejemplo de ruta de decisión: una rápida.

Diriges un taller de servicio de 10 personas con un inventario sencillo, un procesador de pagos y dos contratistas a tiempo parcial. Priorizas la facturación, la nómina, el acceso multiusuario, informes claros y un coste moderado.

Resultado del cuadro de mando: Xero o QuickBooks. Si busca la interfaz de usuario más sencilla y la colaboración entre contable y cliente, elija Xero. Si desea la máxima compatibilidad con aplicaciones con nómina integrada, elija QuickBooks. Recuerde tener en cuenta las reglas y el coste de la nómina local.

Xero

Investopedia

Tabla comparativa de referencia rápida (conceptual)

| Software | Características principales | Notas / Fuente |

|---|---|---|

| QuickBooks en línea | Funciones amplias, ecosistema más pesado, costos de nómina adicionales | QuickBooks |

| Xero | Experiencia de usuario limpia, buena conciliación y pagos sólidos a socios. | Xero, El Australiano |

| Libros Zoho | El mejor precio, ideal si se utiliza Zoho Stack | Zoho, Tech.co |

| FreshBooks | Ideal para autónomos y proveedores de servicios. | — |

| Ola | Funciones básicas gratuitas, nóminas pagas y pagos | — |

Después de la implementación: manténgalo en funcionamiento

Mensualmente: conciliar el banco, revisar AR/AP antiguos, realizar copias de seguridad de los datos.

Trimestral: reunirse con el contador, revisar informes, modificar presupuestos.

Anual: si su software sigue siendo adecuado. Los proveedores de software cambian los precios y las características. Lo que es "adecuado" hoy puede no ser la herramienta adecuada en 18 meses. Considere las tareas de usar una aplicación de software y planifique una revisión trimestral, además de tener una reunión anual de estrategia con su contador.

Lista de verificación final antes de comprar (copiar, no imprimir)

¿Te permite realizar tu contabilidad principal? ☐ Sí ☐ No

¿Te permite gestionar la nómina según tu jurisdicción y complejidad? ☐ Sí ☐ No

¿Tiene integraciones nativas con tus aplicaciones críticas? ☐ Sí ☐ No

¿Puede su contador acceder al sistema y extraer estados financieros compatibles con GAAP/IFRS? ☐ Sí ☐ No

¿Puedes exportar una copia de seguridad completa y un balance de comprobación? ☐ Sí ☐ No

¿Has calculado el coste total para 12 meses, incluyendo los complementos planificados y las comisiones de pago? ☐ Sí ☐ No

¿El proveedor publica sus prácticas de seguridad y ofrece autenticación de dos factores? ☐ Sí ☐ No

Si respondiste “No” a más de una, no lo compres todavía.

Dónde aprender más (y rápidamente)

Puede consultar comparaciones y precios en reseñas de la industria y en las páginas web de precios de los proveedores. Los precios de los principales proveedores de software cambiaron en 2026, así que verifique los planes actuales antes de comprometerse. Las fuentes de referencia rápida son: suscripciones a QuickBooks y notificaciones de cambios de precio, información sobre precios de Xero, páginas de precios y planes de Zoho Books, y guías comparativas actualizadas de revisores de confianza.

- Precios de QuickBooks

- Precios de Xero

- Precios de Zoho Books

- Guía del software de contabilidad de Investopedia

Cierre: cómo elegiría si estuviera en tu posición

Deja de buscar el producto perfecto y elige al proveedor que:

- Pasa la evaluación básica de contabilidad y nómina.

- Tiene integraciones nativas para sus aplicaciones críticas.

- Se adapta a su presupuesto de 12 meses (incluidos los complementos planificados).

Comienza tu proceso mensual. Usa el nuevo sistema en paralelo durante 30 días. Haz que tu contador participe en el proceso de selección y migración. Si lo deseas, cuéntame qué aplicaciones usas actualmente (banco, comercio electrónico, proveedor de nóminas), cuántos empleados tienes y si trabajas con varias divisas. Evaluaré tres proveedores según tu situación particular y te proporcionaré un plan de migración.

Hecho.