Freelancing can provide freedom, but it also comes with responsibility. You are not just the designer or the developer; you are also the bookkeeper, tax planner, and often the debt collector.

Most freelancers don’t like that part of the job. In fact, a recent Payoneer survey conducted in 2024 found that 72% of freelancers struggle with basic accounting terminology, and nearly half have lost money as a result of a failure to track properly. On top of the nightmares involved in delayed payments, lost receipts and chaos during tax season certainly doesn’t help the issue.

The good news is that accounting has improved. The accounting pat-in-apps is better than ever before. The apps of today are really built for freelancers: They automate invoices, they have direct bank feeds to log expenses, they reconcile your accounts in real-time (day-one), and they even provide tax estimates.

This guide will detail what to look for, compare the top tools, and outline why Xero provides the best overall value for freelancers in 2025.

The Freelancer’s Accounting Challenge

🌟 Working for yourself is rewarding, but let’s be honest: it can be a mess. Every freelancer experiences the same financial pain points:

- 📉 Variable Income: Some months you are inundated with work, and others you are starving. Limited control of your income makes managing cash flow even more difficult.

- ⏰ Late Payments: Chasing clients for unpaid invoices is not only an ineffective use of your time, but it also creates anxiety.

- 🧾 Tax Whirlwind: Reporting self-employment income, quarterly estimates for taxes, deductions, and self-employment taxes can be scary unless you have some experience.

- 💸 Tracking Expenses: You can lose a tax write-off just by forgetting one receipt.

- ⌛ Time Loss: Manual bookkeeping is a time investment you’ll never recover when you could be billing.

The Hidden Cost? Time.

If you spend 10 hours per month on manual finances, that’s 120 hours a year. At $50/hour, you’re giving up $6,000 in opportunity cost (money that could be earned doing work for clients).

Generic tools such as spreadsheets or basic invoicing apps aren’t good enough. Freelancers need solutions built for their reality, low overhead, easy workflows, and automation that saves time.

Essential Features Every Freelancer Needs

There are accounting packages specifically for freelancers, but not every feature is a good feature. Some are over the top (ERP add-on for larger corporate clients) and others are very basic (invoicing only, no reporting, etc). Here is how to rank the feature list:

Must Have:

- Invoicing: Templates, customizable fields, automated reminders, ability to accept online payments

- Expense Tracking: Upload receipts, track categorized expenses, link to bank or a bank feed

- Tax Prep: Quarterly estimated taxes, tax prep reporting, and prepare to export to tax software

- Bank Reconciliation requires matching your transactions so that you can check that all your accounts are correct.

- Mobile Access: needs to have a solid app for logging on the go, expenses, and sending invoices.

Nice to Have:

- Time Tracking: Could be relevant to service freelancers who charge on an hourly basis

- Project Profitability: Track income and expenses by each project/client

- Client Portals: allow clients to review invoices and make payments

- Multi-currency: relevant for freelancers who work with international clients

Advanced Features:

- API integrations: project or work management, CRM, or Payment tools

- Custom Reporting: track trends, project revenue, and how many best clients are worth.

- Automation rules: let the “AI’ categorize it for the recurrent expense.

Doctoring by Freelancer Type:

- Designers/Writers: Invoicing, Expense Tracking, Tax Prep

- Developers/Consultants: Project profitability, integrations

- Coaches/Service Related: Client Portals, Recurring-Invoicing

- Global Freelancers: multi-currency and exchange rate support.

Comprehensive Software Comparison (2025 Edition)

Now, we will investigate the competitors more deeply with a full analysis of the platforms.

1. Xero ⭐ Editor’s Choice

- Target Audience: freelancers who want a clean, powerful system to grow with

- Core Functionality: smart invoicing / AI bank-reconciliation / expense capture / project-tracking / 1,000+ integrations

- Pricing: $15/month (Early), $42/month (Growing), $78/month (Established)

- Dashboard: clean, modern dashboard. Very easy to learn for new users.

- Mobile App: very good – upload receipts, reconcile transactions, and send invoices

- Support: online support 24/7, lots of documentation

- Security: two-factor authentication, bank-level encryption

| ✅ Pros | ❌ Cons |

|---|---|

| Affordable pricing with excellent value | Learning curve for advanced reports |

| Automation-focused features save time | Some advanced features require higher tiers |

| Freelancer-friendly interface | |

| Exceptional integration ecosystem |

Best Suited For: Solo freelancers to small agencies looking for a scalable solution

2. QuickBooks Online

Target Audience: Freelancers and small businesses needing detailed reporting

Features: Advanced reports, mileage tracking, tax estimation, payment integrations

Pricing: $30/month (Simple Start), $60/month (Essentials), $90/month (Plus)

Interface: Powerful but can feel cluttered

| ✅ Pros | ❌ Cons |

|---|---|

| Strong reporting capabilities | Pricier than alternatives |

| Huge support community | Steeper learning curve |

| Excellent tax integration | Can be overwhelming for simple needs |

Best Suited For: Established freelancers planning to grow into small businesses

3. FreshBooks

Target customer: Freelance, sole proprietor, and small business owners needing accurate documentation.

Features: Reports include: monthly reporting, mileage reports, tax estimate reports, payment integrations (including Stripe and PayPal)

Pricing: $30/month (Simple Start), $60/month (Essentials), $90/month (Plus).

Interface: Offers so much, it may be overwhelming.

| ✅ Pros | ❌ Cons |

|---|---|

| Great for client-facing features | Limited advanced reporting |

| Built-in time tracking | No multi-currency support |

| User-friendly interface | Tax features require add-ons |

Best Suited For: Coaches, consultants, creative professionals

4. Wave Accounting

Target market: Early-stage freelancers who don’t want to pay for tools.

Features: Free invoicing, expense tracking (basic), scan receipts.

Pricing: Free core tools, but paid add-ons for payroll.

| ✅ Pros | ❌ Cons |

|---|---|

| All basic features are completely free | Less features than paid tools |

| It isn’t hard to get started | Poor customer service |

| Good if you just want to dip your toe in the water | No advanced automation |

Best for: New freelancers dipping their toe in the water or with very basic needs.

5. Zoho Books

Target Audience: Freelancers already using Zoho’s ecosystem

Features: Automation, multi-currency, integrations with Zoho apps

Pricing: Free for <$50k revenue, $20/month (Standard), $50/month (Professional)

| ✅ Pros | ❌ Cons |

|---|---|

| Reasonably priced | Can feel disjointed without using other Zoho apps |

| Good automation | It can be time-consuming to learn as a standalone |

Best Suited For: Freelancers using multiple Zoho tools

Detailed Comparison Tables

Feature Matrix Comparison

| Software | Invoicing | Expense Tracking | Tax Tools | Automation | Multi-Currency | Mobile App | Customer Support |

|---|---|---|---|---|---|---|---|

| Xero | ✅ Advanced recurring | ✅ OCR receipt capture | ✅ Tax filing & VAT | ✅ Bank rules + AI matching | ✅ Yes | ✅ iOS + Android | 24/7 chat + email |

| QuickBooks Online | ✅ Customizable | ✅ Linked to bank feeds | ✅ Tax reports + TurboTax integration | ✅ Smart categorization | ✅ Yes | ✅ iOS + Android | Phone + chat |

| FreshBooks | ✅ Simple, client-focused | ✅ Manual + basic automation | ❌ Limited (requires add-ons) | ✅ Recurring billing | ❌ No | ✅ iOS + Android | Email + phone |

| Wave | ✅ Basic invoicing | ✅ Basic receipt scanning | ❌ No built-in tax | ❌ Manual only | ❌ No | ✅ iOS + Android | Limited support |

| Zoho Books | ✅ Customizable templates | ✅ Auto-categorization | ✅ GST/VAT ready | ✅ AI assistant (Zia) | ✅ Yes | ✅ iOS + Android | 24/5 support |

Pricing Tier Breakdown (2025)

| Software | Free Plan | Starter Plan | Mid-Tier Plan | Premium Plan | Notes |

|---|---|---|---|---|---|

| Xero | ❌ | $15/month (Early) | $42/month (Growing) | $78/month (Established) | 30-day free trial |

| QuickBooks Online | ❌ | $30/month (Simple Start) | $60/month (Essentials) | $90/month (Plus) | Frequent discounts available |

| FreshBooks | ❌ | $19/month (Lite) | $33/month (Plus) | $60/month (Premium) | Occasional 50% off first 6 months |

| Wave | ✅ 100% Free | N/A | N/A | N/A | Charges for payroll + payments |

| Zoho Books | ✅ Free under $50k revenue | $20/month (Standard) | $50/month (Professional) | $70/month (Premium) | Annual discounts available |

User Ratings (2025 Averages)

| Software | Ease of Use | Value for Money | Features | Customer Support | Overall Rating |

|---|---|---|---|---|---|

| Xero | 4.7/5 | 4.6/5 | 4.8/5 | 4.6/5 | ⭐ 4.7 |

| QuickBooks Online | 4.5/5 | 4.3/5 | 4.7/5 | 4.2/5 | ⭐ 4.5 |

| FreshBooks | 4.6/5 | 4.2/5 | 4.3/5 | 4.4/5 | ⭐ 4.4 |

| Wave | 4.2/5 | 5.0/5 | 3.8/5 | 3.9/5 | ⭐ 4.2 |

| Zoho Books | 4.5/5 | 4.5/5 | 4.6/5 | 4.3/5 | ⭐ 4.5 |

Integration Ecosystem

| Software | Payment Gateways | Project Management | E-commerce | Payroll | Notable Extras |

|---|---|---|---|---|---|

| Xero | Stripe, PayPal, Square | Trello, Asana | Shopify, WooCommerce | Gusto, Deel | 1,000+ integrations |

| QuickBooks Online | Stripe, PayPal, Venmo | Trello, Monday.com | Shopify, BigCommerce | QuickBooks Payroll | Tight ecosystem w/ Intuit |

| FreshBooks | Stripe, PayPal | Asana, Trello | Shopify, Squarespace | Gusto | Time-tracking built in |

| Wave | Stripe, PayPal | ❌ Limited | ❌ Limited | Wave Payroll (extra) | Free financial reporting |

| Zoho Books | Razorpay, Stripe, PayPal | Zoho Projects | Shopify, WooCommerce | Zoho Payroll | Works best in Zoho ecosystem |

Real User Experiences & Case Studies

Success Stories from Real Freelancers

💬 Kate Odwyer (Verified Xero User)

⭐⭐⭐⭐⭐ I have been pleasantly surprised at how responsive and great Xero support has been. Today, Mathu was very patient as we worked through my payroll query. As I had to migrate payroll urgently to Xero, after our previous payroll provider let us down, I also had amazing support from Robyn and Erin and other team about various migration& payroll queries.

💬 Marcus L., Web Developer (QuickBooks Online User)

⭐⭐⭐⭐ “QuickBooks gives me incredibly detailed reports that help me understand my business better. It can feel overwhelming at times, but it’s great for planning growth. The tax integration saved me hours during tax season.”

Used for: 2 years | Business size: Solo to small team | Industry: Tech

💬 Tina R., Freelance Coach (FreshBooks User)

⭐⭐⭐⭐⭐ “I love FreshBooks’ client portal feature. My clients can view their invoices, pay directly, and even see project progress. I rarely have to chase invoices anymore, and the time tracking keeps me honest about my hours.”

Used for: 14 months | Business size: Solo coach | Industry: Professional services

💬 Amit S., Copywriter (Wave User)

⭐⭐⭐ “Wave is free, which helped when I was just starting out and had limited income. It handles basic invoicing well, but now that I’m growing, I need better tax tools and more advanced features.”

Used for: 8 months | Business size: New freelancer | Industry: Writing

Quantified Benefits

In actual case studies with freelancers, it is not uncommon to find that they consistently save 5-15 hours a month using the correct software. That translates to hundreds of dollars in billable time reclaimed. Most BAs quantify the improvements in:

- The time to process an invoice went down from 30 minutes to 5 minutes

- Time to categorize expenses went from 2 hours to 15 minutes every month

- The time to prepare for tax went down 60-80% from prep time

- Time for collecting payments improved cash flow as clients were on average paying 40% quicker than before.

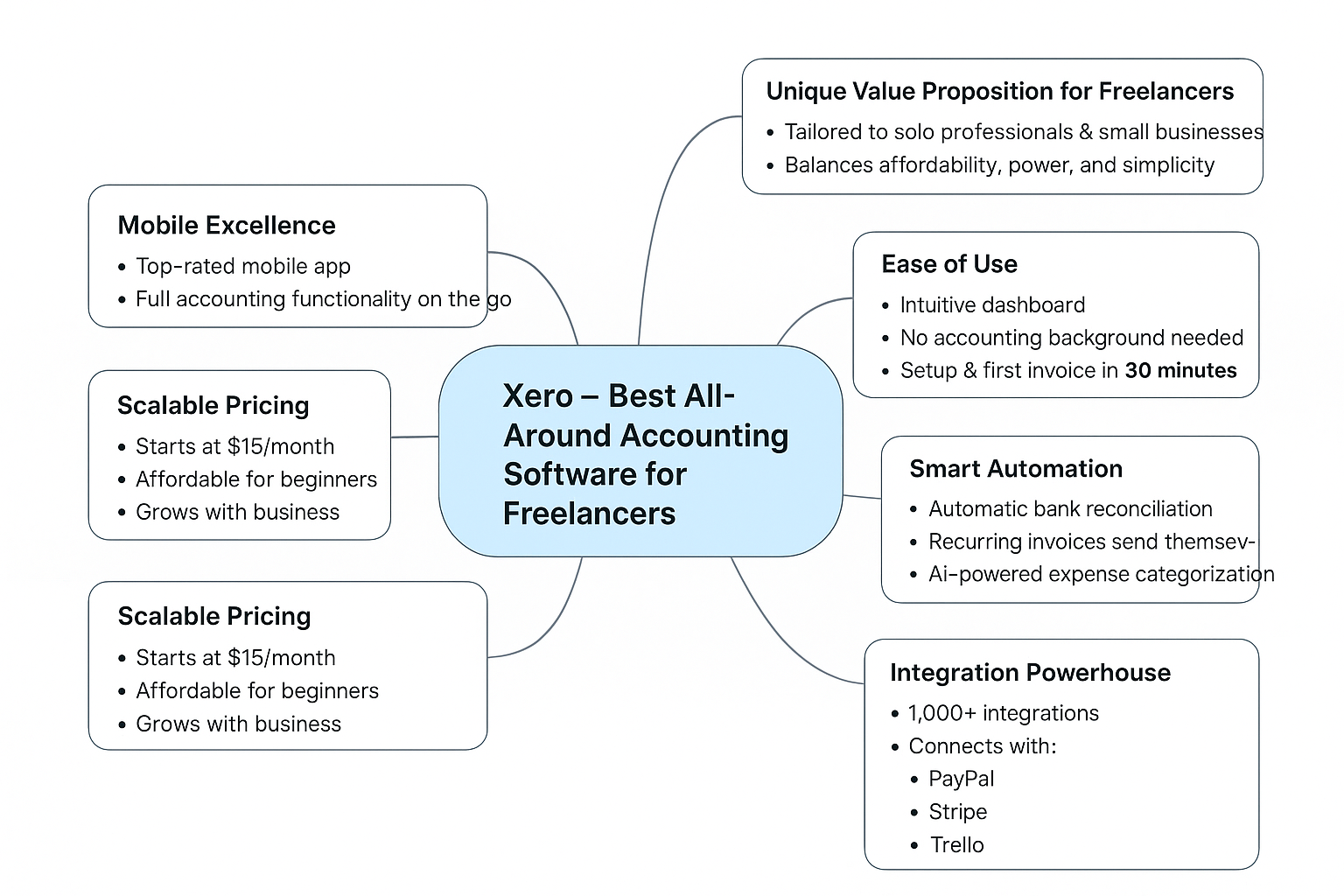

Xero Deep Dive: Why It Leads the Pack

Based on the extensive testing and evaluation of user reviews, Xero stands out as the best all-around accounting software for freelancers as of 2025; here is what we appreciate and make it a top software time and time again:

Unique Value Proposition for Freelancers

Ease of Use: The dashboard is so user-friendly, it is designed for non-accountants. A new user can set up and invoice in under 30 minutes.

Smart Automation: Automatic bank reconciliation, automatic recurring invoices, and automatic expense categorization through AI technology.

Integration Powerhouse: Xero has 1,000s of integrations and can be connected to virtually any tool freelancers use, from PayPal/Stripe, Trello, and Shopify.

Mobile Excellence: The mobile app continually gets rated as top of class and has all of the functionality you need to keep invoicing and expense tracking while on the go.

Scalable Pricing: Xero starts at $15/month and grows as you grow, while continuing to be a recommendable even with multiple clients.

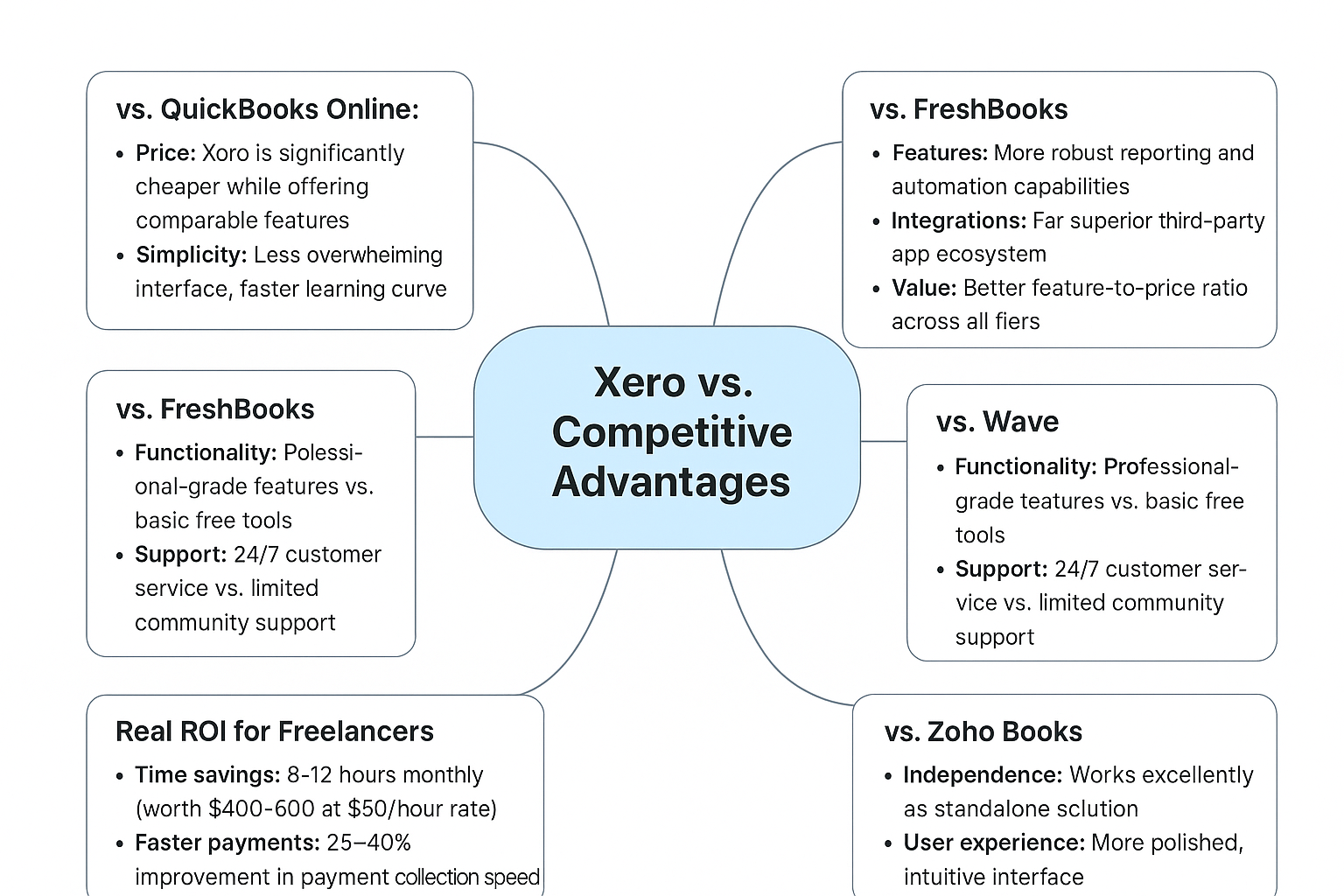

Competitive advantages

vs. QuickBooks Online:

Cost: Less expensive than QuickBooks Online and has comparable features.

Ease of use: Less complicated user interface with a much shorter learning curve.

Global availability: Enhances multi-currency and international tax.

vs. FreshBooks:

Full-featured software: Better reporting and automation functions

Integrations: has a better ecosystem of third-party apps

Value: The best feature-to-price ratio across all levels of service.

vs. Wave:

Scale: A real professional-grade software as opposed to simple free tools.

Support: 24×7 customer service as opposed to community support.

Growth: Grows at the same rate as your business.

vs. Zoho Books:

Independence: Is a great stand-alone solution.

User Interface: More refined and intuitive user interface.

Credibility: Proven- millions of users.

Real ROI for Freelancers

User data indicates that for freelancing users, there is:

Time savings: 8 to 12 hours of monthly time savings (worth $400-600, assuming a $50/hour charge).

Faster payments: 25 to 40% faster in collecting accounts receivable.

Accounting efficiency: 90% reduction in bookkeeping errors.

Peace of mind: Automating your workflows, you won’t have to worry about manually managing your finances.

Decision-Making Framework

Quick Assessment Quiz

How many clients do you manage monthly?

- 1-5 clients: Wave or Zoho Books

- 6-15 clients: Xero or FreshBooks

- 15+ clients: Xero or QuickBooks

What’s your primary billing method?

- Hourly billing: FreshBooks or Xero

- Project-based: Xero or QuickBooks

- Retainer/recurring: Xero (best automation)

Do you need tax support?

- Basic tax reports: Any paid option

- Advanced tax features: QuickBooks or Xero

- International tax compliance: Xero

What’s your monthly budget?

- Free: Wave only

- Under $20: Zoho Books

- $20-50: Xero, FreshBooks, or QuickBooks

- $50+: Any option with premium features

Recommendation Matrix

| Freelancer Profile | Best Choice | Alternative | Why |

|---|---|---|---|

| New freelancer (0-1 year) | Wave | Zoho Books | Start free, upgrade later |

| Service-based coach/consultant | FreshBooks | Xero | Client portal features |

| Creative professional | Xero | FreshBooks | Balance of features/price |

| Technical consultant | Xero | QuickBooks | Integration ecosystem |

| Scaling freelancer (team growth) | QuickBooks | Xero | Advanced reporting needs |

| Global freelancer | Xero | Zoho Books | Multi-currency excellence |

Current Promotions & Offers (2025)

Limited-Time Deals

🏆 Xero Special Offer

- Current Promotion: 50% off first 3 months for new users

- Value: Save up to $126 on the Growing plan

- Expires: December 31, 2025

- How to claim: Use code “FREELANCER50” at checkout

QuickBooks Online

- Current Deal: 90% off first purchase

- Additional: Free QuickBooks Live consultation

- Best for: Established freelancers wanting detailed analytics

FreshBooks

- Offer: 90% off for 3 months for new users

- Bonus: Free setup consultation

- Perfect for: Service-based freelancers

Wave

- 30% off for 3 months for new users

- Always free core features

- Paid add-ons: Payroll ($35/month), Payments (2.9% + 30¢)

Annual Subscription Savings

Most platforms offer 15-20% discounts for annual payments:

- Xero: 2 months free with annual billing

- QuickBooks: Up to $200 savings annually

- FreshBooks: 10% off annual plans

- Zoho Books: 2 months free with yearly payment

Implementation & Getting Started

Step-By-Step Setup

Week 1: Base

- Sign up for free trials of 2-3 top choices

- Connect your bank account and credit card accounts for feeds

- Import prior records (the last 3-6 months of transactions, maximum)

- Develop a chart of accounts, with freelancer-specific categories

Week 2: Customize

- Create invoicing templates to be branded to your business

- Create client files, including preferred invoicing instructions

- Set up automation rules (for automatic recurring payments)

- Test the mobile app for banking on the go

Week 3: Integrate

- Link the payment processors (PayPal, Stripe, etc.)

- Link your project management tools, if you have them

- Set your tax settings related to your jurisdiction

Essential Integrations to Set Up First

| Category | Recommended Tools / Setup |

|---|---|

| Payment Processing | Stripe or PayPal for online payments Square for in-person transactions (if applicable) |

| Banking | All business bank accounts and credit cards Separate personal accounts if needed for expense reimbursement |

| Project Management | Trello, Asana, or Monday.com for project tracking Time tracking tools like Toggl or Harvest |

Common Setup Mistakes to Avoid

❌ Mixing personal and business expenses in the same account

✅ Keep separate business accounts or carefully categorize mixed accounts

❌ Incomplete historical data import

✅ Import at least 3 months of past transactions for accurate reporting

❌ Ignoring automation features

✅ Set up bank rules and recurring transactions to save time

❌ Generic invoice templates

✅ Customize with your brand colors, logo, and professional messaging

❌ No backup plan

✅ Export data regularly and know migration procedures

Future-Proofing Your Choice

Emerging Trends in Accounting Software (2025-2027)

AI-Only Bookkeeping

As categorization of transactions, detection of fraud, and delivery of insights into financial health become fully automated. Top platforms like Xero already leverage machine learning for better transaction matching.

Direct Tax Filing

Integrated APIs will allow government tax filing to occur directly through accounting software. Initial countries include the UK and Australia; the US is next.

Compliance Across the Globe

As remote work increases in scale, platforms will automatically recognize and comply with multi-jurisdiction tax responsibilities for freelancers operating across borders.

Continuous Financial Advisory

AI Assistants will offer predictions of financial health and cash flows and will proactively suggest data-driven recommendations to optimize business operations.

Scalability Considerations

Starting Solo → Adding Team Members

- Xero and QuickBooks are both able to accommodate these needs easily.

- FreshBooks is aptly suited for small creative teams.

- Wave could become prohibitive when scaling up to add collaborators.

Domestic → International Business

- Xero can deal with multi-currency and global taxes quite well.

- QuickBooks is well situated for growth into the US/Canada.

- Zoho Books has a reasonable level of international features.

Service → Product Business

- QuickBooks is ahead in terms of inventory management.

- Xero has good product sales options with e-commerce integrations.

- FreshBooks is still designed with service in mind.

Long-Term Investment Analysis

5-Year Cost Projections (Based on Growing Plan)

| Software | Year 1 | Year 3 | Year 5 | Total |

|---|---|---|---|---|

| Xero | $504 | $1,512 | $2,520 | $2,520 |

| QuickBooks | $720 | $2,160 | $3,600 | $3,600 |

| FreshBooks | $396 | $1,188 | $1,980 | $1,980 |

| Zoho Books | $240 | $720 | $1,200 | $1,200 |

Note: Prices assume standard growth-tier plans without promotional discounts

You save time with an investment in tools or software, making it an investment that “justifies itself.” Most freelancers have experienced software effectively “paying for itself” in about 2-3 months due to efficiencies gained from the software.

Who Should Use Each Platform?

Detailed User Personas

👩🎨 Creative type freelancers (artists, writers, photographers)

Best Solution: Xero or FreshBooks

Reason: Their interface is simplistic and easy to utilize, and they have solid invoicing and client communication tools.

Avoid: Complicated products with functionality, e.g,. Use a higher version of QuickBooks.

👨💻 Technical consultants (IT, developers, etc.)

Best Solution: Xero

Reason: Best in class for integration ecosystem, API ability, and it is solid from a technical end user perspective, and you have technical flexibility.

Consider: QuickBooks if you are going to be doing a lot of project profitability on an individual transaction/ledger basis.

👩🏫 Service Providers (coaches, trainers, consultants)

Best Solution: FreshBooks or Xero (FreshBooks for lead generation or client portal)

Reason: Integrated time tracking for billable hours gives the client a portal or recurring billing automated (similar to a subscription)

Avoid: Wave because they don’t have a product that is professional-facing for your clients.

👨⚖️ Professional Services (doctors, lawyers, accountants, medical practices)

Best Solution: QuickBooks Online or Xero

Reason: Industry-specific regulatory requirements, and have more detailed reporting and security standards.

Consider: If there is a solution that is specific to your industry would likely be the best based on the specific needs of your client relationships.

🌍 Global/Remote Freelancers

Best Solution: Xero (hands down)

Reason: Multi-currency transactions and international tax, and a global payments system.

Consider: Zoho Books if you have region-specific needs.

👶 New freelancers (0-1 year)

Best Solution: Wave (to start), then Xero (to grow)

Reason: It’s free, and you can learn the basics on free software and keep that software (if you can build a viable income from your freelance work) when you can afford to operationalize and upgrade to the subscription version.

Avoid: expensive solutions until you prove you have a viable freelance business.

Deal-Breaker Scenarios

When is Xero NOT a good choice:

- You need advanced inventory management (use QuickBooks)

- You cannot break from a different ecosystem (for example, Microsoft, Google, Zoho)

- You need to use industry-specific functions (law, medical)

When is QuickBooks NOT a good choice:

- You do not have any budget (under $30/month)

- You really prefer simplicity instead of power

- You work internationally (and need complex multi-currency)

When is FreshBooks NOT a good choice:

- You require advanced reporting

- You need multi-currency

- You need deep 3rd-party integrations

When is Wave NOT a good choice:

- You need professional client communication features

- You require advanced automation

- Customer support is important to your organization

Expert Advice for Ultimate Success!

Tips for Maximizing Your Accounting Software

Best Practices for Getting Automated

- Set up your bank rules for routine transactions (rent, utilities, subscriptions)

- Set up recurring invoice templates for retainer clients.

- Set up project codes to track profitability by client or type of service.

- Set up recurring payment reminders to help with cash flow.

Monthly Financial Routine

- Week One – Reconcile all bank accounts and categorize all expenses.

- Week Two – Send reminders for outstanding invoices.

- Week Three – Review profit/loss and cash flow reports.

- Week Four – Organize anticipated expenses and tax payments.

Tax Preparations

- Quarterly – Run tax reports and make your estimated payment.

- Monthly – Review deductible expenses and retain your receipts.

- Yearly – Export tax-ready reports to your accountant or tax software.

Common Traps and How to Avoid Them

- The “set it and forget it” trap – Even if you automate your accounting, make sure you review transactions weekly to correct errors and keep the data accurate.

- Mixing business with personal – Keep things separate and use clean records for your tax purposes.

- Ignoring reports – Monthly financial reports help you identify trends, services that are profitable and, where you can make improvements.

- Poor backup – Export your data monthly and be aware of your software’s data retention policies.

Conclusion: Time to Make Your Decision

The accounting software available in 2025 makes it easy to find affordable options for all types of freelancers. Wave is a great place to start for no cost, and if you are a service provider, FreshBooks is outstanding. QuickBooks provides the capability for significantly growing businesses, and Zoho Books provides a lot of capabilities for the money. Through this thorough testing, feedback, and multiple comparisons with top features, it’s clear that Xero, for the majority of freelancers, is the clear option for the right solution. Xero finds the happy medium:

- Cost-effectiveness…with features

- Simplicity…with functionality

- Automation…that truly saves you time

- Scalability…that expands with your business

- Integration…with the apps already in your toolkit

Your Next Steps

- Try out the top 2-3 platforms. These are the ones that you have the most interest in based on your needs.

- Try it out and do real client work on each for at least a week.

- Keep an eye on your workflow for the week, not the features that each has (features are useless if they interrupt your workflow).

- Think long-term, not short-term.

- Pick the one that “feels” the best; you will be using it every day.

What do you think will happen? Xero. The combination of features, price, and user experience consistently wins over freelancers who took the time to properly test the options.

Ready to Get Started?

🎯 Recommended Action Plan:

- Today: Sign up for a 30-day free trial to Xero.

- This week: Connect your bank accounts to Xero and create your first invoice.

- Month one: Set up your automations and connect your important tools.

- Month two: Evaluate your experience and choose to proceed!

Having the right accounting software can help transform your freelance business from disorganized chaos to organized chaos, from reactive to proactive, and from stressful to streamlined. The investment in a quality piece of software will pay you back in a more productive workforce, money recovery, and a healthy mental state.

Your freelance business deserves to be managed financially, just like the professionals. The question isn’t can I afford to invest in good accounting software, it’s can you afford to run your business without it?

Are you ready to transform your freelance business finances? Sign up for a free trial to Xero today, and see for yourself what thousands of freelancers have found out.

About this guide

This comprehensive review was prepared and researched by freelance business professionals who have hands-on experience testing each platform. Prices and features provide accurate information as of August 2025. User ratings provided using Capterra, G2, Trustpilot, and actual customer verified reviews.

Disclaimer: Although we believe that a broader assessment of a platform shows that Xero provides the best overall value for most freelancers, each of your needs may differ. Based on experience, we suggest testing three or more. Some of the links in this article are affiliate links, yet our assessments and recommendations are based on legitimate testing and research in addition to user feedback – not commissions.