The battle of Australia’s top accounting software – which one should YOU choose?

What Are Xero and MYOB?

If you’re running a business in Australia or New Zealand, you’ve probably heard about Xero and MYOB. These are the two biggest names in accounting software down under, and choosing between them can feel overwhelming!

MYOB (Mind Your Own Business) has been around since the early 1980s – that’s over 40 years! It was THE dominant player in Australian accounting software for decades. Today, MYOB has about 1.2 million users, mostly in Australia and New Zealand. They offer different products including MYOB Business (cloud-based) and MYOB AccountRight (hybrid desktop/cloud).

Xero is the newer kid on the block, founded in 2006 in Wellington, New Zealand. But don’t let its youth fool you – Xero has absolutely exploded! It now has over 4.4 million subscribers worldwide and dominates the Australian market with about 60% market share. It’s 100% cloud-based and built from the ground up for the modern digital age.

Quick Comparison at a Glance

| Feature | Xero | MYOB Business | MYOB AccountRight |

|---|---|---|---|

| Starting Price (AUD) | $35/month | $12/month | $50/month |

| Deployment | 100% Cloud | Cloud-based | Hybrid (Desktop + Cloud) |

| Number of Users | Unlimited | Unlimited | Varies by plan |

| Free Trial | 30 days | 30 days | Demo available |

| Market Share (Australia) | ~60% | ~30% | Included above |

| Total Users | 4.4M+ worldwide | 1.2M (AU/NZ) | |

| Integrations | 1,000+ | Limited | Limited |

| User Rating | 4.4/5 | 3.8/5 | 4.0/5 |

Pricing: What Will You Actually Pay?

Let’s break down the costs for Aussie businesses!

Xero Pricing (AUD)

| Plan Name | Price | Users | What You Get |

|---|---|---|---|

| Starter | $35/month | Unlimited | 20 invoices, 5 bills, bank reconciliation, basic reporting |

| Standard | $70/month | Unlimited | Unlimited invoices & bills, multi-currency, quotes |

| Premium | $105/month | Unlimited | Everything + project tracking, expenses, multi-currency |

🎉 Special Offer: Xero often runs promotions offering 90% off for the first 6 months! This can bring the Starter plan down to just $3.50/month initially.

MYOB Business Pricing (AUD)

| Plan Name | Price | Users | What You Get |

|---|---|---|---|

| Solo (App only) | ~$5.50/month | 1 user | Mobile-only, invoicing, basic features |

| Lite | $12/month | Unlimited | Up to 2 employees, basic accounting, payroll $2/employee |

| Pro | $31.50/month | Unlimited | Unlimited payroll ($2/employee), timesheets, multi-user |

MYOB AccountRight Pricing (AUD)

| Plan Name | Price | Best For |

|---|---|---|

| Plus | ~$50/month | Growing businesses, inventory tracking |

| Premier | ~$80/month | Larger businesses, unlimited payroll included, multi-currency |

💰 Winner: MYOB for Entry Price!

MYOB starts cheaper at $12/month vs Xero’s $35/month. But Xero offers better value overall with unlimited users and more features!

The Market Battle: Who’s Winning in Australia?

The Numbers Tell an Interesting Story

MYOB was the king from the 1980s through to the mid-2000s. Every Australian accountant knew MYOB, and it was the default choice for small businesses.

But Xero changed the game. By being cloud-first from day one, Xero rode the wave of digital transformation. Today, Xero dominates with about 60% of the Australian market, while MYOB holds around 30%.

Many accountants say MYOB is “playing catch-up” to Xero’s innovation, though MYOB still has loyal fans who love its payroll features and traditional feel.

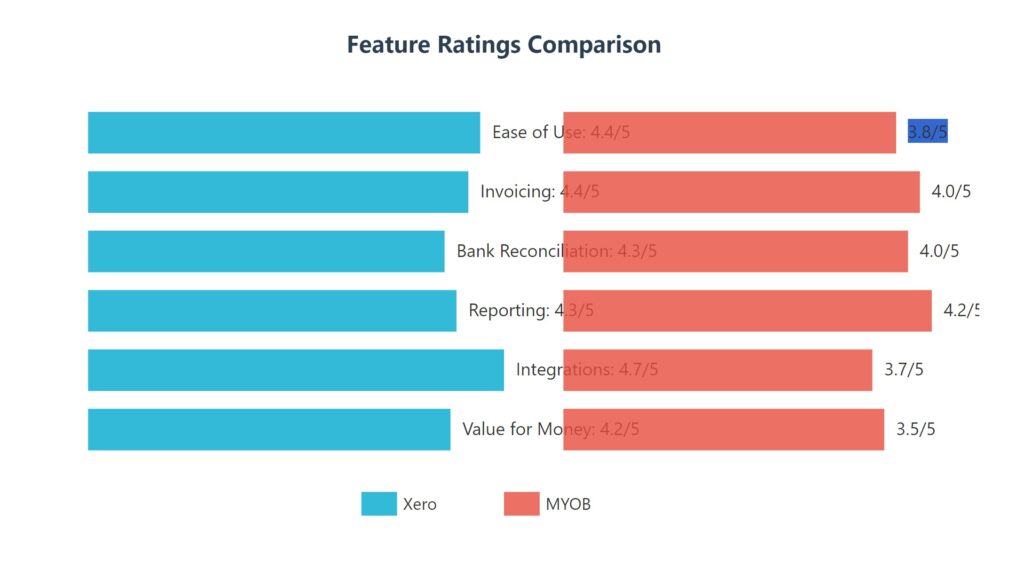

Feature Comparison: What Can They Do?

Invoicing & Getting Paid

Xero’s Approach: Xero makes invoicing beautiful and simple. You can create professional invoices in minutes, set up recurring invoices, and send automatic payment reminders. The integration with payment processors like Stripe and GoCardless means customers can pay with one click. Plus, you can track when they open your invoice!

MYOB’s Approach: MYOB’s invoicing is straightforward and gets the job done. You can customize invoices, track them, and even integrate with payment systems. It’s not as sleek as Xero, but it’s reliable and familiar to many Australian businesses.

Winner: Xero 🏆

More modern, better automation, and easier payment collection!

Payroll – The Big Difference!

This is where MYOB really shines! Let’s compare:

| Feature | Xero | MYOB |

|---|---|---|

| Payroll Included? | No – needs add-on or integration | Yes! In Pro plan and above |

| Payroll Cost | Separate subscription (e.g., Gusto) | $2 per employee/month (MYOB Business) |

| Unlimited Payroll | Depends on integration | ✅ Yes (AccountRight Premier) |

| Single Touch Payroll (STP) | ✅ Yes (via integrations) | ✅ Yes (built-in) |

| Ease of Use | Very easy (Xero Payroll) | Good once set up |

Winner: MYOB! If payroll is super important to your business, MYOB has a clear advantage. It’s built-in, straightforward, and cost-effective, especially for businesses with many employees. MYOB AccountRight Premier even includes unlimited payroll at no extra charge!

Bank Reconciliation

Xero: Bank reconciliation in Xero is absolutely brilliant. It automatically imports your bank feeds, learns from your patterns, and suggests matches. You can reconcile weeks of transactions in just minutes! Many users say it’s faster than MYOB.

MYOB: MYOB also offers automatic bank feeds and reconciliation. It works well, but users report it’s not quite as smooth or fast as Xero. The interface feels a bit more “old school” but gets the job done reliably.

Reporting & Financial Insights

Both platforms offer solid reporting, but they have different strengths:

Xero provides clean, easy-to-understand reports that look great. You get all the essentials: P&L, balance sheet, cash flow, GST, and more. Reports are real-time and can be customized. Perfect for business owners who want quick insights!

MYOB offers comprehensive reporting, especially in AccountRight. The reports are detailed and great for accountants who need deep analysis. Some users find them more complex but more powerful for detailed financial work.

Integrations & Add-ons

🔌 Massive Win for Xero!

Xero: 1,000+ app integrations | MYOB: Limited integrations

Xero connects with everything:

- E-commerce: Shopify, WooCommerce, Amazon

- Payments: Stripe, PayPal, Square

- Payroll: Gusto, Employment Hero

- CRM: HubSpot, Salesforce

- Inventory: Unleashed, Cin7

- Project management: And hundreds more!

MYOB has integrations but nowhere near as many. It focuses more on doing things within the software itself rather than connecting to third-party apps. This can be good or bad depending on your needs!

User Access & Collaboration

Both Xero and MYOB Business offer unlimited users – which is fantastic! You can add your accountant, bookkeeper, business partner, and team members without paying extra.

However, MYOB AccountRight charges per user, which can add up quickly for growing teams.

Ease of Use: Which is Friendlier?

Xero – Modern & Intuitive

- Beautiful, clean interface

- Easy for beginners to learn

- Minimal accounting jargon

- Excellent mobile app (4.5/5)

- Real-time collaboration

- Rated 4.4/5 for ease of use

- Loved by startups and modern businesses

MYOB – Traditional & Reliable

- Familiar to Aussie accountants

- MYOB Business is fairly user-friendly

- AccountRight has a steeper learning curve

- More traditional accounting terminology

- Desktop option for those who prefer it

- Rated 3.8/5 for ease of use

- Better if you already know MYOB

Winner: Xero! Almost everyone agrees that Xero is easier to learn and use, especially if you’re not an accountant. MYOB feels more “old school” and requires more training.

Customer Support: Getting Help When You Need It

| Support Type | Xero | MYOB |

|---|---|---|

| Phone Support | ❌ No | ✅ Yes |

| Live Chat | ✅ Yes (24/7) | ✅ Yes (limited hours) |

| Email Support | ✅ Yes | ✅ Yes |

| Help Center | ✅ Extensive and excellent | ✅ Good |

| Community Forum | ✅ Very active globally | ✅ Active in AU/NZ |

| Video Tutorials | ✅ Comprehensive | ✅ Available |

Mixed results: MYOB wins for offering phone support, but many users complain about long wait times and unhelpful responses. Xero’s 24/7 chat support gets better reviews for being faster and more helpful, even without phone support!

What Real Australian Users Are Saying

⭐ Overall Ratings

Xero: 4.4 out of 5 stars | MYOB Business: 3.8 out of 5 stars

Positive Reviews for Xero

“Best decision we ever made!”

“We switched from MYOB to Xero last year and it’s been amazing. The interface is so much cleaner, bank reconciliation is faster, and we love the app integrations. Our accountant loves it too!” – Melbourne Small Business Owner

“Perfect for our growing team”

“Unlimited users is a game-changer. We’ve added 8 people to our Xero account at no extra cost. With MYOB we would have been paying heaps more!” – Sydney Startup

“Makes accounting actually enjoyable”

“I’m not an accountant, but Xero makes me feel like I know what I’m doing. Everything is where I expect it to be, and I can do my books from my phone. Can’t imagine going back to MYOB!” – Brisbane Freelancer

Positive Reviews for MYOB

“Excellent payroll features”

“We have 15 employees and MYOB’s payroll is brilliant. Single Touch Payroll is built-in, and at $2 per employee per month, it’s way cheaper than adding payroll to Xero. Perfect for Aussie businesses!” – Perth Business Owner

“Familiar and reliable”

“We’ve used MYOB for 20 years and it just works. Our accountant knows it inside out, and we’re comfortable with it. Not the flashiest, but gets the job done every time.” – Adelaide Family Business

“Great for Australian compliance”

“MYOB is built for Aussie businesses. GST, BAS, STP – it’s all there and it’s all compliant with ATO requirements. Makes tax time so much easier!” – Gold Coast Accountant

Common Complaints

Xero users mention:

- No phone support (chat only)

- Payroll requires separate setup/integration

- Can feel expensive as you add features

- Basic inventory management (needs add-ons for complex needs)

MYOB users mention:

- Interface feels dated and clunky

- Customer support has long wait times

- Fewer integrations with other apps

- AccountRight requires manual EOFY rollover (Xero doesn’t)

- Can be slow during peak times (EOFY)

- Windows-only for some features

Pros and Cons Summary

Xero

✅ Pros

- Much easier to use and learn

- Beautiful, modern interface

- 1,000+ app integrations

- Unlimited users on all plans

- Excellent mobile app

- Superior bank reconciliation

- No manual EOFY rollover needed

- 60% Australian market share

- Real-time collaboration

- Better value for growing businesses

- Higher user ratings (4.4/5)

❌ Cons

- No phone support

- Payroll requires add-on

- Higher starting price ($35 vs $12)

- Basic inventory (needs apps for complex needs)

- Fewer local MYOB-loyal accountants

MYOB

✅ Pros

- Cheapest starting price ($12/month)

- Excellent payroll features built-in

- Unlimited payroll (AccountRight Premier)

- Phone support available

- Familiar to older Australian accountants

- 40+ years of Australian business focus

- Desktop option available (AccountRight)

- Comprehensive compliance features

- Good for businesses with many employees

❌ Cons

- Interface feels outdated

- Steeper learning curve

- Far fewer integrations (vs 1000+ for Xero)

- Customer support has mixed reviews

- Manual EOFY rollover required (AccountRight)

- Some features are Windows-only

- Can be slow during peak times

- Losing market share to Xero

- Lower user ratings (3.8/5)

Which Should You Choose?

Choose Xero if you:

- Want modern, easy-to-use software

- Need lots of app integrations

- Are a startup or growing business

- Want superior mobile access

- Value unlimited users

- Don’t need complex payroll

- Want automatic EOFY processing

- Like working in the cloud

- Want the market leader

Choose MYOB if you:

- Need excellent payroll features

- Have many employees

- Want the cheapest entry price

- Prefer phone support

- Already know MYOB well

- Your accountant prefers MYOB

- Want desktop software option

- Like traditional accounting software

Interesting Statistics You Should Know

60%

Xero’s market share in Australia (2025)

4.4M+

Xero subscribers worldwide

1,000+

App integrations available for Xero

40+ years

MYOB has been serving Australian businesses

My Personal Experience and Recommendation

Why I Prefer Xero (And Most Aussie Businesses Do Too!)

I’ve used both MYOB and Xero extensively with various Australian businesses, and I have to be honest – Xero is my clear winner. Let me explain why!

It’s Just So Much Easier!

I started with MYOB back in the day, and it did the job. But when I switched to Xero, it felt like jumping from Windows 95 to a modern smartphone! Everything is intuitive, clean, and just makes sense. I can find what I need in seconds, not minutes.

My clients who aren’t accountants LOVE Xero because they can actually understand it. With MYOB, they’d call me confused. With Xero, they rarely need help.

The Integration Ecosystem is Incredible

This is huge! I run an online business, so I need my accounting software to talk to Shopify, Stripe, my CRM, my project management tools, and more. Xero connects to everything seamlessly. With MYOB, I’d be doing so much manual work or paying for expensive middleware.

Want to add a new tool to your business? There’s probably a Xero app for it. It’s like having an iPhone vs a basic mobile phone – the app ecosystem makes ALL the difference.

Bank Reconciliation is a Breeze

I used to dread reconciling my bank accounts with MYOB. So many clicks, so much time. With Xero, I can reconcile a month’s worth of transactions in 10 minutes flat! The smart matching learns from your patterns and gets better over time. It’s honestly magical.

No EOFY Stress!

Remember how MYOB AccountRight needs a manual end-of-financial-year rollover? That was always stressful. Xero just… works. It’s continuous. No cutover, no stress, no “did I do it right?” panic. It’s one less thing to worry about!

The Mobile App is Outstanding

I can literally run my business from my phone with Xero. Send an invoice while having coffee? Done. Check my cash flow while waiting for a meeting? Easy. Reconcile a transaction from the beach? Why not! MYOB’s mobile experience doesn’t even come close.

Unlimited Users is Brilliant

I’ve added my accountant, my bookkeeper, my business partner, and three team members to Xero. All at no extra cost! The collaboration is seamless – we can all work in real-time, leave notes for each other, and everyone sees the same data instantly.

But What About MYOB’s Strengths?

I’ll be fair – MYOB does have some advantages. If you have lots of employees and payroll is your main concern, MYOB’s built-in payroll at $2 per employee is excellent value. And some old-school accountants still prefer MYOB because they’ve used it for 30 years.

But here’s the thing: even for payroll, you can integrate Xero with Employment Hero or Gusto, and the experience is just as good (often better!) than MYOB’s payroll.

The Market Numbers Don’t Lie

Xero now has 60% of the Australian market. That’s HUGE! It means:

- More accountants and bookkeepers know it

- More apps and integrations support it

- More training resources available

- It’s the future-proof choice

The Pricing Isn’t As Different As It Seems

Yes, MYOB starts at $12 vs Xero’s $35. But once you add what you actually need (payroll, multi-user access for AccountRight, integrations), the costs become very similar. And Xero often runs 90% off promotions that make the first 6 months super cheap!

Plus, Xero’s value is incredible – unlimited users, 1000+ integrations, no EOFY hassles, better mobile app. You get more bang for your buck.

Is Xero Perfect? Let’s Be Real…

No software is perfect. I wish Xero had phone support (though their chat is actually really good). And if you have super complex inventory needs, you might need to add an app like Unleashed or Cin7.

But these are minor niggles compared to the overall brilliance of the platform.

My Bottom Line:

For 90% of Australian small businesses in 2025, Xero is the obvious choice. It’s easier, more modern, better integrated, and more future-proof than MYOB. The market is voting with its wallets – Xero is dominating for good reasons!

MYOB made sense in the 2000s. But in 2025, Xero is where it’s at. Join the 60% of Aussie businesses who’ve already made the switch – you won’t regret it!

I give Xero a solid 9/10. MYOB Business gets a 6/10, and MYOB AccountRight gets a 6.5/10.

Xero is my clear winner! 🏆

Final Verdict: The Clear Winner for Australian Businesses

After comparing features, pricing, ease of use, user reviews, and market trends, here’s my conclusion:

For most Australian small to medium businesses, Xero is the clear winner because:

- Much easier to learn and use (4.4/5 vs 3.8/5 rating)

- Dominates the Australian market with 60% share

- 1,000+ integrations vs MYOB’s limited options

- Superior mobile app and cloud experience

- No manual EOFY rollover needed

- Better bank reconciliation

- Real-time collaboration with unlimited users

- More future-proof as the market leader

Choose MYOB only if:

- You have many employees and payroll is your #1 priority

- You’re already deeply familiar with MYOB

- Your accountant strongly prefers MYOB

- You want the absolute cheapest entry price

- You need phone support (despite mixed reviews)

Making the Switch from MYOB to Xero

Thinking of switching? It’s easier than you think! Xero offers migration tools and can import your data from MYOB. Many accountants specialize in helping businesses make the switch, and thousands of Australian businesses do it every year.

The transition usually takes a few hours to a couple of days, but the long-term benefits are worth it!

Try Them Both – They’re Free for 30 Days!

Both Xero and MYOB offer 30-day free trials. My advice? Try both with your real business data and see which one feels right for YOU!

During your trial:

- Create invoices and see which is faster

- Connect your bank and try reconciling

- Generate some reports – which are clearer?

- Test the mobile app – which works better for you?

- Invite your accountant or bookkeeper – get their opinion

Frequently Asked Questions

Can I switch from MYOB to Xero easily?

Yes! Xero has migration tools specifically for MYOB users. You can transfer your customers, suppliers, chart of accounts, and historical data. Many Australian accountants specialize in helping businesses make this switch smoothly.

Which is more popular with Australian accountants?

It depends on the accountant’s age and training! Older accountants often prefer MYOB because they’ve used it for decades. Younger accountants overwhelmingly prefer Xero for its modern features and collaboration capabilities. Overall, more accountants are now Xero-certified than MYOB-certified.

Do both work with the ATO for tax returns?

Yes! Both Xero and MYOB are ATO-approved and connect directly with the ATO for BAS, GST, and tax submissions. Both support Single Touch Payroll (STP) for reporting to the ATO.

Which is better for e-commerce businesses?

Xero wins hands-down! It has native integrations with Shopify, WooCommerce, Amazon, eBay, and dozens of other e-commerce platforms. MYOB’s integrations are much more limited.

Can I use them both on Mac?

Xero works perfectly on Mac, PC, tablet, and phone – it’s 100% cloud-based. MYOB Business also works on Mac. However, MYOB AccountRight is Windows-only for the desktop version (though you can access it via cloud on Mac).

Which has better inventory management?

For basic inventory, both are similar. For complex inventory needs, neither is perfect! Most businesses with serious inventory requirements use Xero or MYOB with a specialized inventory app like Unleashed, Cin7, or TradeGecko.

Conclusion: Make the Right Choice for Your Aussie Business

Choosing your accounting software is a big decision that will impact your business for years to come. Both Xero and MYOB are solid options, but they serve different needs and different types of businesses.

Xero is the modern, cloud-first choice that’s dominating the Australian market. With 60% market share, 4.4/5 star ratings, 1,000+ integrations, and unlimited users, it’s the best choice for most growing Australian businesses. It’s easier to use, better integrated, and more future-proof.

MYOB is the traditional, reliable choice with 40+ years of Australian business experience. It has excellent payroll features and is great if that’s your main priority. But it’s losing market share to Xero for good reasons – it feels dated, has fewer integrations, and is harder to use.

For me and the majority of Australian businesses, Xero is the clear winner in 2025. The numbers don’t lie – 60% market share, higher user ratings, and thousands of businesses switching from MYOB to Xero every year tell you everything you need to know!

But don’t just take my word for it – try both free trials and make your own decision. Just remember: the grass is greener on the Xero side! 🌟

Good on ya for doing your research! Here’s to your business success! 🇦🇺 🚀