When you choose accounting software, you’re not simply paying for a tool. You are buying a system to run the financial backbone of your business – invoicing, bank reconciliation, reporting, compliance, payroll, and much more! You choose the wrong one, and you will be paying for software that limits you or makes you upgrade too quickly. You choose the right one, and it works quietly to help you do your work faster, easier, and more accurately.

Xero is one of the more popular cloud accounting platforms, especially for SMEs, freelancers, and accountants wanting everything in one place. But with three pricing plans – Starter, Standard, and Premium – and all the add-ons and discounts for multiple organisations, it can be confusing to know which plan is best suited for you.

This 2025 in-depth guide will dissect the Xero pricing and what you actually get in each plan, the hidden costs, and help you make the right decision from the outset.

Xero Pricing at a Glance (2025)

| Plan | Monthly Price (USD) | Best For | Core Limits / Features |

|---|---|---|---|

| Starter | $29 | Freelancers & very small businesses | 20 invoices/quotes per month, enter 5 bills, bank reconciliation, Hubdoc receipt capture |

| Standard | $46 | Growing small businesses | Unlimited invoices & bills, bank reconciliation, Hubdoc, short-term cash flow & business snapshot |

| Premium | $69 | Businesses dealing in multiple currencies | All Standard features + multi-currency support |

Add-ons:

- Expenses – from $4/month

- Projects – from $7/month

- Analytics Plus – from $7/month

Why the Right Plan Matters

The difference between tiers is not about what the software can do. It’s about how much you can use it and if you have access to specific features like multi-currency.

Before diving into the tiers, just remember this: Xero’s basic functions are pretty solid overall.

Here’s why choosing the right tier upfront matters:

- Hard caps on your usage can bring your workflow to a screeching halt (a problem with the Starter plan).

- Add-ons have extra costs, and the costs can add up.

- When you upgrade in the middle of the year, this can change your reporting and cash flow tracking.

- It makes budgeting for the year easier when you know your actual monthly costs.

Plan 1: Starter — $29/month

Who it’s for

- Freelancers

- Solo consultants

- Side hustlers with low transaction volumes

- Micro-businesses under $50k/year turnover

The Starter plan is Xero’s entry-level option. It’s affordable and includes all the core accounting tools, but it comes with strict limits that most growing businesses will quickly outgrow.

Included Features:

- Send up to 20 invoices/quotes per month

- Enter up to 5 bills per month

- Bank reconciliation

- Hubdoc integration to capture bills and receipts

- Short-term cash flow and business snapshot tools

What’s missing:

- Unlimited invoicing

- Bulk reconciliation

- Multi-currency support

- Project tracking unless you pay for an add-on

| Pros | Cons |

|---|---|

| Low cost for basic needs | Limits are too tight for most growing businesses |

| Great for testing Xero before committing | No room to scale without upgrading |

Verdict: A fine starter point for freelancers and very small businesses, but not a long-term solution if you expect even moderate transaction growth.

Plan 2: Standard — $46/month

Who it’s for

- Small businesses with consistent monthly transactions

- Service-based companies without international payments

- Retailers operating in a single currency

The Standard plan removes the volume limits, making it Xero’s most popular option for everyday business operations.

Included Features:

- Unlimited invoices and quotes

- Unlimited bills

- Bank reconciliation

- Hubdoc integration

- Short-term cash flow and business snapshot

- Bulk reconciliation for faster processing

Key benefits:

- No usage caps — perfect for steady or growing businesses

- Balanced cost-to-feature ratio

- All essentials for domestic business accounting

What’s missing:

- No multi-currency

- Still requires add-ons for expenses, projects, or advanced analytics

Verdict: The sweet spot for most domestic businesses. You get everything you need without overpaying for features you don’t.

Plan 3: Premium — $69/month

Who it’s for

- Businesses trading internationally

- Companies paying or receiving in multiple currencies

- E-commerce businesses selling globally

The Premium plan includes everything in Standard, plus multi-currency support.

Included Features:

- All Standard plan features

- Multi-currency invoicing, payments, and reporting

- Automatic currency conversions at daily rates

Verdict: If you regularly deal with overseas clients or suppliers, Premium is essential. If you don’t, stick with Standard and save the $23/month.

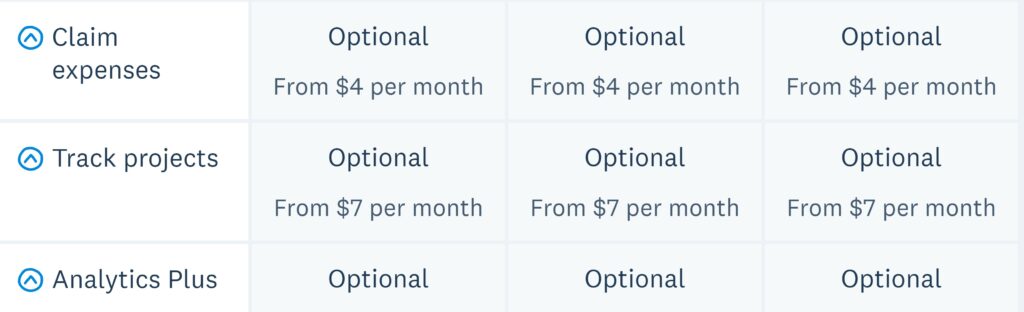

Xero Add-ons (Optional Costs)

Xero’s plans cover core accounting, but some features require extra fees.

- Expenses – from $4/month

Track and manage employee expense claims. - Projects – from $7/month

Track time, costs, and profitability for projects. - Analytics Plus – from $7/month

Get advanced forecasting and trend analysis.

Hidden cost warning: Premium + all add-ons can push your bill to $87/month.

Discounts for Multiple Organisations

If you manage more than one business in Xero:

- Use the same subscriber email and country edition for automatic discounts.

- If businesses are in different countries, contact Xero support for a manual discount.

- Discounts are applied per additional organisation.

Feature Comparison Table

| Feature | Starter | Standard | Premium |

|---|---|---|---|

| Monthly Price (USD) | $29 | $46 | $69 |

| Invoices & Quotes Limit | 20 | Unlimited | Unlimited |

| Bills Limit | 5 | Unlimited | Unlimited |

| Bank Reconciliation | Yes | Yes | Yes |

| Hubdoc Receipt Capture | Yes | Yes | Yes |

| Short-term Cash Flow Tools | Yes | Yes | Yes |

| Bulk Reconciliation | No | Yes | Yes |

| Multi-Currency | No | No | Yes |

| Add-on: Expenses | $4/mo | $4/mo | $4/mo |

| Add-on: Projects | $7/mo | $7/mo | $7/mo |

| Add-on: Analytics Plus | $7/mo | $7/mo | $7/mo |

Cost Scenarios: Yearly Projection

| Plan | Base Cost (USD/year) | With All Add-ons | With 2 Businesses (10% discount) |

|---|---|---|---|

| Starter | $348 | $528 | $470 |

| Standard | $552 | $732 | $677 |

| Premium | $828 | $1,044 | $1,489 (for two orgs with add-ons) |

Real-World Scenarios

Scenario 1: Freelancer

- Sends 8 invoices/month, tracks 3 bills

- Works with local clients only

- Best fit: Starter

Scenario 2: Local retail shop

- Sends 40 invoices/month, tracks 20 bills

- Operates in USD only

- Best fit: Standard

Scenario 3: E-commerce brand selling globally

- Sends 100+ invoices/month

- Accepts EUR, GBP, USD

- Best fit: Premium

Common Mistakes When Choosing a Plan

- Starting too small — Many pick Starter to save money, then upgrade within months.

- Ignoring add-on costs — They can raise your bill by 25–40%.

- Not factoring currency needs — Occasional foreign transactions still justify Premium.

- Forgetting seasonal spikes — A busy quarter can blow through Starter’s caps.

Xero vs QuickBooks vs FreshBooks

| Feature | Xero Standard | QuickBooks Plus | FreshBooks Plus |

|---|---|---|---|

| Price (USD/month) | $46 | $115 | $140 |

| Unlimited invoices | Yes | Yes | Yes |

| Multi-currency | No (Premium only) | Yes (included) | Yes (included) |

| Projects | Add-on | Included | Included |

| User limit | Unlimited* | 5 users | Unlimited |

*Xero charges per organisation, not per user.

How to Choose the Right Plan

Ask yourself:

- Do I send more than 20 invoices/month?

- Yes → Skip Starter

- Do I pay/receive in foreign currency?

- Yes → Premium

- Do I need project tracking or expense claims?

- Yes → Budget for add-ons

- Do I run multiple businesses?

- Yes → Check discount eligibility

Xero’s Primary Service Regions

🇳🇿 New Zealand

🇦🇺 Australia

🇬🇧 United Kingdom

🇺🇸 United States

🇨🇦 Canada

Final Thoughts

The gap between Starter and Standard isn’t about features — it’s about limits. For most growing businesses, those limits will force an upgrade. Premium is for companies dealing with multiple currencies. And while Xero’s add-ons increase flexibility, they also bump up the monthly bill.

If you want to future-proof your accounting without overpaying, start with Standard unless your business model clearly requires Premium from day one.